What is a Bear Put Spread? How do you buy put options on a discount with a bear put spread?

Bear Put Spread - Introduction

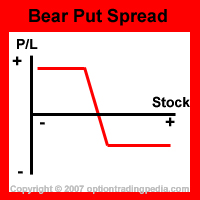

A Bear Put Spread is a bearish option strategy that profits when the underlying stock falls. This is also one of the best bearish debit spread options strategy, capable of optimizing your potential profits for when you are certain that the price of the underlying stock is going to go down to a definite price and not beyond.

A Bear Put Spread is the reverse of a Bull Call Spread and works the same way in the opposite direction. The Bear Put Spread involves simultaneously buying to open and selling to open options of the same expiration month, making it a Vertical Spread and because you need to pay money to put on this position, resulting in a net debit, this is also a Debit Spread.

|

|

Bear Put Spread - Classification

Strategy : Bearish | Outlook : Moderately Bearish | Spread : Vertical Spread | Debit or Credit : Debit

When To Use Bear Put Spread?

One should use a Bear Put Spread when one is confident in a moderate drop in the price of the underlying asset.

How To Use Bear Put Spread?

Establishing a Bear Put Spread involves the purchase of an At The Money or In The Money put option on the underlying asset while simultaneously writing (sell to open) an Out of the Money put option on the same underlying asset with the same expiration month. Ideally, you should be writing the out of the money put options at the strike price at which you think the stock is going to drop down to but not further than.

Buy ATM Put + Sell OTM Put

Bear Put Spread ExampleExample : Assuming QQQQ at $44. Buy To Open 10 QQQQ Jan44Put for $1.05, Sell To Open 10 QQQQ Jan43Put for $0.50 Net Debit = $1.05 - $0.50 = $0.55 If you expect QQQQ to go down to near $42 by expiration, you will Sell to Open QQQQ Jan42Put instead. |

The profitability of a bear put spread can be enhanced or better guaranteed by legging into the position properly.

Trading Level Required For Bear Put Spread

A Level 3 options trading account that allows the execution of debit spreads is needed for the Bear Put Spread. Read more about Options Account Trading Levels.

Profit Potential of Bear Put Spread :

The Bear Put Spread profits when the stock goes down. When that happens, the long put option goes up in price along with the underlying asset while the short put options continue to decay in premium.

Profit Calculation of Bear Put Spread:

Maximum Return = (Difference in strikes - Net Debit) ÷ Net Debit

|

Following up from the above example:

Buy to open 10 QQQQ Jan44Put for $1.05 per contract and sell to open 10 QQQQ Jan43Put for $0.60 per contract Max. Return = (44 - 43 - (1.05 - 0.60)) ÷ (1.05 - 0.60) = 0.55 ÷ 0.45 = 122% Max. Risk = Net Debit = $1.05 - $0.60 = $0.45, if QQQQ is > $44 Break Even = Higher Strike - Net Debit = $44 - $0.45 = $43.55 |

Risk / Reward of Bear Put Spread:

Upside Maximum Profit: Limited

Maximum Loss: Limited

Net Debit Paid

Break Even Point of Bear Put Spread:

BEP: Strike Price of Long Put Option - Net Debit Paid

Advantages of Bear Put Spread :

Disadvantages of Bear Put Spread :

Adjustments for Bear Put Spread Before Expiration :

1. If the underlying asset is expected to continue to fall strongly beyond the strike price of the short put option, one could buy to close the out of the money short put option and then sell to open a further out of the money put option in its place.

2. If the underlying asset is expected to continue to fall strongly beyond the strike price of the short put option, one could also choose to buy to close the out of the money short put option and then simply allow the long put option to continue to gain in value.

3. If the underlying stock is expected to pull up upon reaching the strike price of the short put options, you could close the profitable long put options when the strike price of the short put options are reached and then buy out of the money put options in order to transform the position into a Bull Put Spread. This transformation can be automatically performed without monitoring using a Contingent Order.

Bear Put Spread Questions:

:: What To Do When Short Leg of Put Spread is Assigned?

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by