Learn how to profit in both up and down directions with the Long Straddle

Long Straddle - Introduction

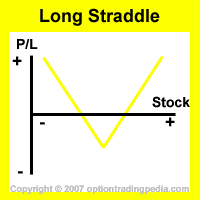

The Long Straddle or simply a Straddle, is a volatile option strategy that profits no matter if the underlying asset goes up or down. Yes, a Long Straddle is best used when you expect a stock to stage a breakout to either upside or downside very quickly. Conditions that typically lead to such uncertain breakouts are pending court verdicts or drug approvals.

A Long Straddle works based on the premise that both call and put options have unlimited profit potential but limited loss. While one leg of the Long Straddle losses up to its limit, the other leg continues to gain as long as the underlying stock rises, resulting in an overall profit.

|

|

Straddles, Strangles and Long Guts form the family of basic volatile options strategies and each have their own pros and cons. Here's a comparison table:

| Straddle | Strangle | Long Gut | |

| Max Profit | High | Highest | Low |

| Max Loss | Highest | High | Low |

| Cost of Position | High | Low | Highest |

| Breakeven Points | Narrow | Wide | Widest |

When To Use Long Straddle?

One should use a long straddle when one is confident of a move in the underlying asset but is uncertain as to which direction it may be. Situations that creates an uncertainty as to the direction of move may be just before an important corporate announcement, court verdict, earnings announcement etc... (read about the problem with earnings straddle)

How To Use Long Straddle?

Establishing a long straddle simply involves the simultaneous purchase of an at the money call option and a put option . A call option allows you unlimited profit to upside and limited loss to down side and a put option allows you unlimited profit to downside and limited loss to upside. Combine them both and you will have a long straddle which profits in both up and down market. If you are already holding a long or short stock position, you could establish a Straddle synthetically through the use of a Synthetic Straddle without closing your existing stock position.

Buy ATM Call + Buy ATM Put

|

Long Straddle Example

Assuming QQQQ at $44. Buy To Open QQQQ Jan44Call, buy To Open QQQQ Jan44Put |

Problems With Executing Long Straddle

The problem with the Long Straddle is that you can rarely ever get exactly at the money options. As such, strike price is usually chosen as close to the money as possible. However, the problem with using a straddle that is not exactly at the money is that the overall delta of the position will be skewed to either slightly bullish or slightly bearish inclined. If the strike price used is higher than the price of the stock, the put options would be in the money with higher delta value than the call options, resulting in a negative delta position which gains to downside and loses to upside as the price of the stock moves before expiration. If the strike price used is lower than the price of the stock, the call options would be in the money with higher delta value than the put options, resulting in a positive delta position which gains to upside and loses to downside for the short term.

Long straddles can also be very unprofitable when put on just before an earnings release. This is known as an "Earnings Straddle". Read about the Problems with Earnings Straddle.

Trading Level Required For Long Straddle

A Level 2 options trading account that allows the buying of both call options and put options is needed for the Long Straddle. Read more about Options Account Trading Levels.

Profit Potential of Long Straddle

Long Straddle profits in 3 ways. Firstly, if the stock goes up, the long call option goes up in price along with the stock price while the long put option expires out of the money. Secondly, if the stock goes down, the long put option goes up in price along with the drop in the stock price while the long call option expires out of the money.

The third way the Long Straddle could turn a profit is when the implied volatility of the underlying stock increases, increasing the extrinsic value of both options involved in the position, even if the price of the underlying stock remained stagnant.

Profit Calculation of Long Straddle

% Return = [Exit Price of Underlying Asset - (Strike Price + Net debit)*] ÷ Net Debit

* : If the underlying asset is down, use (Strike Price - Net debit)

| Following up on the above example, assuming QQQQ at $50 at expiration.

Bought the JAN 44 Call for $2.20 Bought the JAN 44 Put for $2.00 % Return = [50 - (44 + 4.20)] ÷ 4.20 = 43% profit Max. Risk = Net Debit = $4.20, if stock remains at $44 Upper Break Even = Strike Price + Net Debit = $44.00 + $4.20 = $48.20 Lower Break Even = Strike Price - Net Debit = $44.00 - $4.20 = $39.80 |

Risk / Reward of Long Straddle

Maximum Profit: UnLimited

Technically, the most the Long Straddle can make to downside is limited to how much the stock can drop, which is limited to a price of $0. In options trading, we label as unlimited profit when an options strategy gains as long as the underlying stock moves.

Maximum Loss: Limited

Net Debit Paid

Break Even Point of Long Straddle

There are 2 break even points to a long straddle. One breakeven point if the underlying asset goes up (Upper Breakeven), and one breakeven point if the underlying asset goes down (Lower Breakeven).

Upper BEP: Strike Price + Net Debit Paid

Lower BEP: Strike Price - Net Debit Paid

Long Straddle Greeks

Delta : Neutral

Delta of Long Straddle is neutral when the strike price is exactly at the money with the delta value of call options at 0.5 and put options at -0.5, neutralizing each other, resulting in no win or lose when the stock make small moves in either direction.

Gamma : Positive

Gamma of Long Straddle is positive and will therefore increase the delta value in the direction of the stock move. If the stock moves upwards, the delta value of the Long Straddle will move away from neutrality to become increasingly positive and if the stock moves downwards, the delta value of the Long Straddle will become increasingly negative. This allows the Long Straddle to profit in either direction.

Theta : Negative

Theta of Long Straddle is negative and will therefore lose value over time due to time decay.

Vega : Positive

Vega of Long Straddle is positive and will therefore gain value as implied volatility rises and loses value as implied volatility drops. As such, it is highly disadvantageous to use a Long Straddle in periods of high implied volatility as a volatility crunch could wipe out all possible profits and more.

Advantages Of Long Straddle

:: Able to profit no matter if the underlying asset goes up or down.

:: Unlimited profit if the underlying asset continues to move in one direction.

:: Saves time from having to analyse if a stock will go up or down ahead of major news releases.

:: Loss is limited to the debit paid.

:: If volatility is low at the time of purchase and volatility rises, both options could profit even without an appreciable change in the stock price.

Disadvantages Of Long Straddle

:: There will be more commissions involved than simply buying call or put options.

:: You can lose more money if the underlying asset stayed stagnant than if you simply bought a call or put option.

:: If the underlying asset rises above the strike price or falls below the strike price but remains below the upper break even or above the lower break even you will still incur a loss on the position.

:: If volatility falls for both or either option, the position could lose with or without a price swing in the underlying asset.

Adjustments for Straddles Before Expiration

1. If the underlying asset has moved beyond its breakeven point and is expected to continue to move strongly in the same direction, one could sell the out of the money option so that some value is recovered from it.

2. If one is very aggressive and confident that the underlying asset will continue to move strongly in the same direction, one could then use the money gained from selling the out of the money option, and buying more contracts of the in the money option.

Long Straddle Related Questions...

:: Combining Covered Call with Straddle?

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by