What are Options Greeks in Options Trading?

What Are Option Greeks?

Have you ever wondered why options prices changes like they do? Why does the price of options seem to have little or no direct relationship with the price of its underlying asset? In fact, why do some call options price actually RISE when the price of its underlying stock DROPS? Yes, all these seemingly strange and random price behaviors of stock options do have a set of logic behind them, the real mechanics behind options price changes modelled by a mathematical formula know as the "Black Scholes Model".

The Black-Scholes model defined 5 main ways the price of an option SHOULD change in relation to its underlying stock, interest rate, volatility, time left to expiration. These parameters became known as the "greeks" as they are defined using greek numerals.

Option Greeks allow option traders to objectively calculate EXPECTED changes in the value of the option contracts in their portfolio with changes in the factors that affects the value of stock options. The ability to mathematically calculate these changes gives option traders the ability to hedge their portfolio or to construct positions with specific risk/reward profiles. This alone makes knowing the Option Greeks priceless in options trading. In fact, nobody can become a true options trader without an indepth knowledge and experience in the dynamics of how options greeks work.

Why Are Options Greeks Important in Options Trading?

For the amateur trader, knowing the delta (Greek Symbol δ) of your options position is the most important as it gives you an indication of how your option's value will change with movements in the underlying stock price - all other variables remaining the same. Knowing your time decay (theta θ) gives you an indication of how much time value your options trading position is losing each day - all other variables remaining the same.

Professionals use the Option Greeks to measure exactly how much they need to hedge their portfolio and to surgically remove specific risk factors

from their portfolio. The Option Greeks also enable the measurement of how much risk the portfolio is exposed to, and where that risk lies (with movements in interest rates or volatility, for example). Having a comprehensive knowledge of options greeks is essential to long term success in options trading.

What Are The 5 Options Greeks?

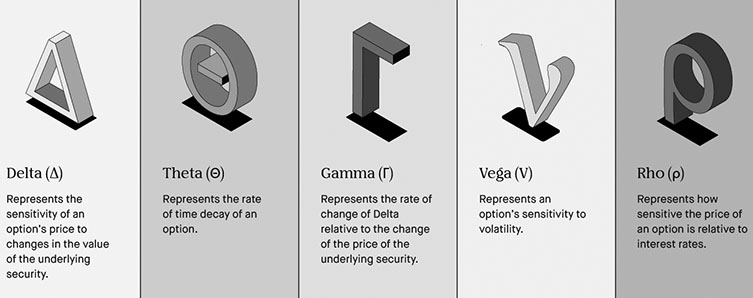

The 5 Option Greeks are:

Delta (Greek Symbol δ) - a measure of an option's sensitivity to changes in the price of the underlying asset

Gamma (Greek Symbol γ) - a measure of delta's sensitivity to changes in the price of the underlying asset

Vega - a measure of an option's sensitivity to changes in the volatility of the underlying asset

Theta (Greek Symbol θ) - a measure of an option's sensitivity to time decay

Rho (Greek Symbol ρ) - a measure of an option's sensitivity to changes in the risk free interest rate

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by