"What To Do When One Leg of Bull Call Spread Is Assigned?"

Question By Justsurf

"What happens if you are assigned the short call on a Bull Call Spread? I have a bull call spread in VISA - Buy Jan75 call @ 3.80 and Sell Jan80 call @ 1.60. Let's say in the short term VISA stocks jumps to $83 and the Jan80 call gets assigned, what do you do? Do you need to exercise the long Jan75 call, buy the stocks (for $7500) and then sell it against the assigned short JAN80 call? Is there any way to address this situation without actually purchasing the stocks? i.e. sell/transfer the JAN75 Call and just Net the difference or something? Thanks!"Asked on 29 Oct 2009 |

Answered by Mr. OppiE

Hi Justsurf,

Nothing breaks a multi-leg options trading strategy more than having one or more short leg assigned. Before you walk away with the idea that being assigned is a bad thing, it is not. When a short position is assigned, all extrinsic value in the contract evaporates in one shot, allowing you to make the full extrinsic value as profit without waiting until expiration. However, such an assignment may dramatically change the nature of a multi-leg options strategy.

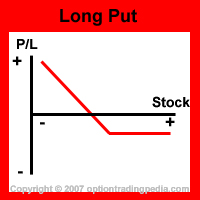

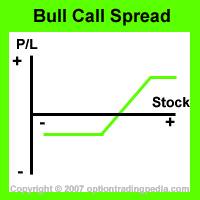

If VISA rallies to $83 and the short Jan80 Calls get assigned, you would end up with a short 100 shares of VISA and long 1 contract of Jan75Call which creates a synthetic long put (Read our tutorial on Synthetic Positions). Compare the risk graph of a synthetic long put (which is the same as a long put) and the risk graph of a Bull Call Spread below:

At this point, legging becomes important if you want to make sure that the profits made are not lost in the process of closing the position due to untimely execution.

In conclusion, when the short call options in your bull call spread is assigned, all you have to do is to close the position by closing out both legs as individual trades. Be sure to leg out of the position correctly to ensure preservation of profits.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by