How Did Options Trading Start In The World?

History of Options Trading - Introduction

Today, business and investment news tout options trading as a new financial innovation or a new trading method known to traders today. However, contrary to popular belief, options trading or the use of options as a financial instrument isn't a new innovation at all. In fact, options trading has a much longer history than most people knew about, a history that goes way back to the times before Christ was born! Indeed, options trading has come a long long way to become the most versatile trading instrument in the world today. Yes, options trading did not just spring from the drawing boards of some financial scientist to become as comprehensive as it is today. Options trading has evolved over thousands of years and understanding the history of options trading gives options traders an appreciation of the depth of this renowned trading instrument.

History of Options Trading - A Timeline

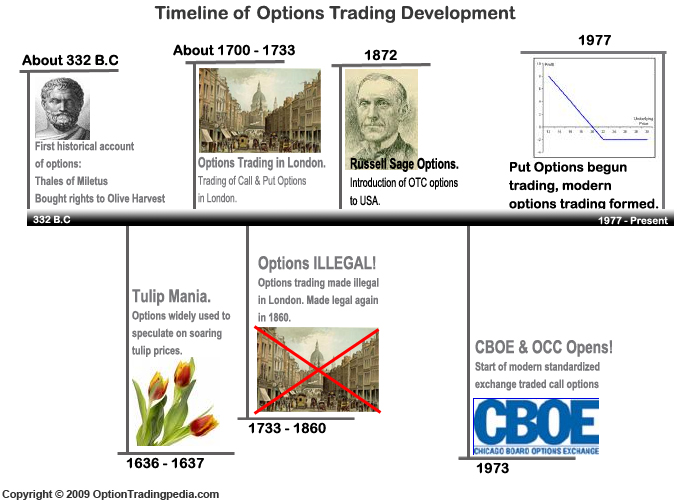

There are a few critical events in the history of Options Trading as you can see from the timeline below:

Brief History of Options Trading

Options trading can be traced back to 332BC where a man known as Thales bought the rights to buy olive prior to a harvest, reaping a fortune. Options then turned up again during the tulip mania of 1636 where options on tulips were widely bought in order to speculate on the soaring price of tulips. A market was then formed towards the end of the seventeenth century in London to trade in both call and put options. That was the first instance of trading both call and put options over an exchange. By 1872, Russel Sage introduced Over The Counter call and put options trading to the United States which was unstandardized and illiquid. The emergence of options trading as we know it today comes with the setting up of the Chicago Board of Options Exchange (CBOE) and the Options Clearing Corporation (OCC) in 1973 where standardized exchange traded call options were introduced. By 1977, put options were also introduced by the CBOE and since then, options trading took on the standardized exchange traded form that we are familiar with today.

History of Options Trading - First Account of Options 332 B.C

The very first account of options was mentioned in Aristotle's book named "Politics", published in 332 B.C. Yes, Before Christ! That's how far back human has used the concept of buying the rights to an asset without necessarily buying the asset itself, yes, an option or what we call in finance as a "Contingent Claim". Aristotle mentioned a man named Thales of Miletus who was a great astronomer, philosopher and mathematician. Yes, Thales was one of the seven sages of ancient greece. By observing the stars and weather patterns, Thales predicted a huge olive harvest in the year that follows. Understanding that olive presses would be in high demand following such a huge harvest, Thales could turn a huge profit if he owned all of the olive presses in the region, however, he didn't have that kind of money. Instead, Thales thought of a brilliant idea. He used a small amount of money as deposit to secure the use of all of the olive presses in the region, yes, a CALL OPTION with olive presses as the underlying asset! As Thales expected, harvest was plentiful and he sold the rights to using all of these olive presses to people who needed them, turning a big fortune.

By controlling the rights to using the olive presses through an option (even though he didn't name it "option" then), Thales had the right to either use these olive presses himself when harvest time came (exercising the options) or to sell that right to people who would pay more for those rights (selling the options for a profit). The owners of the olive presses , who obviously didn't know how the harvest is going to turn out, secured profits through the sale of the "options" to Thales no matter how the harvest turned out. This contingency claim procedure defined how options work since that day and started the long history of options trading. In fact, the olive press owners could be deemed to be the first ever human to have used a Covered Call options trading strategy! Yes, they owned the underlying asset (olive presses in this case) and sold rights to using them, keeping the "premium" on the sale no matter if the presses were eventually used or not!

History of Options Trading - Tulip Mania of 1636

The tulip mania of 1636 in Europe is a classic economics and finance case study where herding behavior created a surge in demand which cause the price of a single commodity, tulips in this case, to soar to ridiculous prices. This surge in price begun the first mass trading of options in recorded history.

All price bubbles burst. On February of 1637, the price of tulip bulbs had gotten so high that it can no longer find sensible buyers to sell to. The buying frenzy immediately turned into a selling frenzy. Price of tulip bulbs collasped quicker than it rose and almost all options speculators were wiped out as their options fell out of the money and worthless. The Dutch economy collasped and people lost their money and homes. Since a lot of options speculators were wiped out during the tulip mania, options trading also gained a notorious reputation for being a dangerous speculative instrument. This is also why you should only trade options in a speculative position with money that you can afford to lose. Maximizing leverage by dumping all your money into a single unhedged call or put options position for the purpose of directional speculation is repeating the history of the tulip mania.

History of Options Trading - Options Trading in London in 1700 to 1860

Even though options trading gained a bad name, it doesn't stop financiers and investors from acknowledging its speculative power through its inherent leverage. Put and Call options were given an organised market towards the end of the seventeenth century in London. With the lessons learnt from the tulip mania still fresh in mind, trading volume was low as investors still feared the "speculative nature" of options. In fact, there was growing opposition to options trading in London which ultimately led to options trading being declared illegal in 1733. Since 1733, options trading in London was illegal for more than 100 years until it was declared legal again in 1860. Yes, a ban of more than a century due to ignorance and fear.

History of Options Trading - Options Trading in USA in 1872

Russell Sage, a well known American Financier born in New York, was the first to create call and put options for trading in the US back in 1872.

History of Options Trading - CBOE and OCC formed in 1973

About 100 years following the introduction of options trading to the US market by Russell Sage, the most important event in modern options trading history took place with the formation of the Chicago Board of Exchange (CBOE) and the Options Clearing Corporation (OCC) in 1973. The formation of both institutions truly is a milestone in the history of options trading and have defined how options are traded over a public exchange the way it is traded today.

The most important function of the CBOE is in the standardisation of stock options to be publicly traded. Yes, prior to the formation of the CBOE, options were traded over the counter and are highly unstandardized, leading to an illiquid and inefficient options trading market. In order for options to be openly traded, all options contracts need to be standardized with the same terms across the board. That was what the CBOE did for call options back in 1973. For the first time, the general public is able to trade call options under the performance guarantee of the OCC and the liquidity provided by the market maker system. This structure continues to be used today. By 1977, put options were introduced by the CBOE, creating the options trading market that we know today. Since then, more and more exchanges were set up for options trading and better computational models for the pricing of options were introduced.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by