How Does The Butterfly Spread Work in Options Trading?

Butterfly Spread - Introduction

So, you wish to profit from a sideways stock with as little investment as possible?

Enters the butterfly spread!

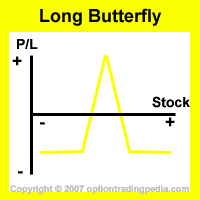

The Butterfly Spread is an advanced neutral option trading strategy which profits from stocks that are stagnant or trading within a very tight price range.

A Butterfly Spread derived its name from the fact that it consists of 3 option trades at once, just like the 2 wings built on the body of a butterfly. This is an options trading strategy where a

very large profit is realised if the stock is at or very near the middle strike price on expiration day. When implemented properly,

the potential gain is higher than the potential loss, but both the potential gain and loss will be limited.

|

|

Butterfly Spread - Classification

Strategy : Neutral | Outlook : Tight Neutral | Spread : Vertical Spread | Debit or Credit : Debit

The Butterfly Spread differs from the Iron Butterfly Spread in that the iron butterfly spread consists of 4 stock options trades instead of just 3 with a larger potential profit and that executing an Iron Butterfly Spread results in a net credit whereas executing a Butterfly Spread results in a net debit.

As Butterfly Spread is a complex options trading strategy comprising of a credit spread on one leg, most brokers will not allow beginner option traders to execute Butterfly Spreads. Only veteran traders with high trading levels are allowed to execute butterfly spreads. You need to check with your broker for the criteria needed to allow the trading of credit spreads or butterfly spreads.

The Butterfly Spread belongs to the family of complex neutral option strategies, similar to the Condor Spread, Iron Butterfly Spread and Iron Condor Spread. Each of them has their own strengths and weaknesses. Here is a table explaining the differences:

| Condor Spread | Iron Condor Spread | Butterfly Spread | Iron Butterfly Spread | |

| Debit/Credit | Debit | Credit | Debit | Credit |

| Max Profit | Low | High | Higher | Highest |

| Max Loss | Highest | Higher | High | Low |

| Cost of Position | High | NIL | Low | NIL |

| Profitable Range | Wide | Widest | Narrow | Wider |

These comparisons are made with the same maximum and minimum strike prices and real values. As you can see from the table above, all of the above complex neutral option strategies comes with their own strengths and weaknesses. Option trading strategies are all about trade-offs. There are no single option trading strategy that has the best of all worlds.

When To Use Butterfly Spread?

One should use a Butterfly Spread when one expects the price of the underlying asset to change very little over the life of the option contracts.

How To Use Butterfly Spread?

There are 3 option trades to establish for this strategy : 1. Buy To Open X number of In The Money Call Options. 2. Buy To Open X number of Out Of The Money Call Options. 3. Sell To Open 2X number of At The Money Call Options.

Buy 1 ITM Call + Sell 2 ATM Call + Buy 1 OTM Call

Veteran or experienced option traders would identify at this point that the butterfly spread actually consists of a Bull

Call Spread and a Bear Call Spread. This is similar to a Condor Spread

except for the fact that the middle strike price has been combined into 1 same middle strike price in order to set up a higher maximum profit potential but a narrower profitable range.

A Butterfly Spread is really a Condor Spread with a narrower profitable range but a higher maximum profit potential.

The choice of which strike prices to buy the long legs (trades 1 and 2 above) at depends on the range within which the underlying asset is expected to trade in. The further

away from the money the 2 long legs are, the lower the risk (as the underlying stock needs to move further in order to exit the breakeven range), and the

lower the potential profits (as the further in the money options will cost a lot more to buy).

|

Butterfly Spread Example :

Assuming QQQQ trading at $43.57. Buy To Open 1 contract of Jan $42 Call at $2.38 Buy To Open 1 contract of Jan $44 Call at $1.06 Sell To Open 2 contracts of Jan $43 Call at $1.63. |

As you see above, the cost of putting on a Butterfly Spread is so low that if you leg into the position properly, it could actually end up as a free position and that is what all professional options traders do.

|

Butterfly Spread Legging In Example :

Assuming QQQQ trading at $43.57. We shall leg into the trade by buying both ITM and OTM calls first then aim to write the ATM calls at a price that covers the price of the position. Buy To Open 1 contract of Jan $44 Call at $1.06 We queued to write the ATM calls at $1.72 instead of its current price of $1.63 and was filled shortly. Sell To Open 2 contracts of Jan $43 Call at $1.72. Net Debit = (($1.72 - $1.06) + ($1.72 - 2.38)) x 100 = $0.00 per position The butterfly spread was successfully legged into and placed for no cost. |

Butterfly Spreads can also be established with the middle strike price at a higher strike price than the price of the underlying stock, turning it into a bullish options trading strategy known as the "Bull Butterfly Spread". One can also put on two butterfly spreads on the same stock in order to target two different strike prices known as the "Double Butterfly Spread".

Trading Level Required For Butterfly Spread

A Level 3 options trading account that allows the execution of debit spreads is needed for the Butterfly Spread. There are brokers who requires level 4 or 5 accounts for Butterfly Spread as well. Please check with your broker. Read more about Options Account Trading Levels.

Profit Potential of Butterfly Spread :

Butterfly spreads achieve their maximum profit potential at expiration if the price of the underlying asset is equal to the middle strike price.

| From the above example : Assuming QQQQ close at $43 at expiration. You will profit from the value of the 2 at the money short call options and you will lose the value of the long out of the money call option and the decay of the in the money call option. |

Profit Calculation of Butterfly Spread:

Maximum Profit = (Middle Strike - Lower Strike - Net Debit) x 100

Profit % = (Max Profit - Net Debit) / Net Debit

|

From the above example : Assuming QQQQ close at $43 at expiration.

Maximum Profit = $43 - $42 - $0.18 = $0.82 x 100 = $82.00 Profit % = ($82 - $18) / $18 = 355% |

Risk / Reward of Butterfly Spread:

Upside Maximum Profit: Limited

Maximum Loss: Limited to net debit paid

Break Even Point (Profitable Range) of Butterfly Spread:

A Butterfly Spread is profitable if the underlying asset expires within the profitable range bounded by the upper and lower breakeven points.

1. Lower Breakeven Point : Net Debit + Lower Strike Price

|

Net Debit = $0.18 , Lower Strike Price = $42.00

Lower Breakeven Point = $0.18 + $42.00 = $42.18. |

2. Upper Breakeven Point : Higher Strike Price - Net Debit

|

Net Debit = $0.18 , Higher Strike Price = $44.00

Higher Breakeven Point = $44.00 - $0.18 = $43.82. |

Profitable Range = $43.82 to $42.18 therefore a $1.64 range

Advantages Of Butterfly Spread:

:: Large profit percentage due to low cost involve in executing the position.

:: Limited risk should the underlying asset rally or ditch unexpectedly. (unlike the Short Straddle)

:: Maximum loss and profits are predictable.

Disadvantages Of Butterfly Spread:

:: Larger commissions involved than simpler strategies with lesser trades.

:: Not a strategy that traders with low trading levels can execute.

Adjustments for Butterfly Spreads Before Expiration :

1. If the underlying asset has gained in price and is expected to continue rising, you could buy back the short call options and

hold the long call options.

2. If the underlying asset has dropped in price and is expected to continue dropping, you could sell the long call options and

hold the short call options. This action is only possible if your broker allows you to sell naked options.

Butterfly Spread Videos

Butterfly Spread

using Simultaneous Order

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by