How Does Short Straddle Work in Options Trading?

Short Straddle - Introduction

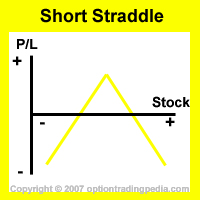

A Short Straddle, is a neutral option trading strategy that profits when a stock stays stagnant. This is the exact opposite of a Long Straddle which profits when the underlying stock moves strongly either to upside or downside. When you execute a Short Straddle, you are in fact selling (or "writing") a Long Straddle to another party. In this sense, the person who bought the Straddle position that you sold, profits when the underlying stock moves strongly in either direction, whereas conversely, you profit when the underlying stock stays stagnant. As you are "Selling" or "Writing" a position, you make in profit the amount of money the buyer paid for the Straddle and that creates a net credit to your account. This is what we call a Credit Spread.

|

|

As a Long Straddle grants you unlimited profit when the underlying asset moves strongly in either direction, it also means that as a writer of a Short Straddle, you are exposed to unlimited loss when the underlying asset fails to stay stagnant. You can also redistribute the risk bias of a short straddle using a Short Strip Straddle or a Short Strap Straddle.

When To Use Short Straddle?

One should use a short straddle when one is of the opinion that an underlying stock will stay sideways until option expiration.

How To Use Short Straddle?

Establishing a short straddle simply involves the simultaneous writing (sell to open) of a call option and a put option on the underlying asset, at the same strike price and expiration date.

This establishes a short call option and a short put option. A short call option allows you to profit when the underlying asset is sideways or down and a short put option allows you to profit when the underlying asset is sideways or up.

Combine them both and you will have a short straddle which profits when the underlying asset stays stagnant or within a tight range.

|

Short Straddle Example

Assuming QQQQ at $44. Sell To Open QQQQ Jan44Call, Sell To Open QQQQ Jan44Put |

Trading Level Required For Short Straddle

A Level 5 options trading account that allows the execution of writing naked options is needed for the Short Straddle. Read more about Options Account Trading Levels.

Profit Potential of Short Straddle :

The Short Straddle reaches maximum profit when both short call and put options expire during expiration. This happens when the underlying asset closes right on the strike price of both legs during expiration. However, even if the underlying stock is slightly up or down during expiration, the option that is In The Money do not gain enough to nullify the value on the expired option, the position still results in a net profit. This upper and lower point where the in the money option gains the exact value of the expire option is called the Upper and Lower Breakeven point.

Profit Calculation of Short Straddle:

Max. Return = Net Credit

% Return = Net Credit � [(Option Strike Price + Highest Option Bid) - Net Credit]

| Following up on the above example, assuming QQQQ at $44 at expiration.

Sold the JAN 44 Call for $2.20 Sold the JAN 44 Put for $2.00 Max Profit = $2.20 + $2.00 = $4.20 |

Risk / Reward of Short Straddle:

Maximum Profit: Limited

Net Credit Received

Maximum Loss: Unlimited

Break Even Point of Short Straddle:

There are 2 break even points to a short straddle. In this case, a breakeven point is the point from which the

position will start to make a loss. One breakeven point if the underlying asset goes up (Upper Breakeven), and one breakeven

point if the underlying asset goes down (Lower Breakeven).

Lower BEP: Strike Price - Net Credit

| Following up on the above example,

Upper Break Even = Strike Price + Net Credit = $44.00 + $4.20 = $48.20 Lower Break Even = Strike Price - Net Credit = $44.00 - $4.20 = $39.80 |

Advantages Of Short Straddle :

:: Able to profit when stock do not move.

:: An initial credit is received on the transaction so the investor does not have to put up any money to enter into the position.

Disadvantages Of Short Straddle:

:: There will be more commissions involved than simply writing naked call or put options.

:: The profit potential is limited to the net credit recieved and nothing more.

:: The margin requirements for this strategy are fairly high.

Adjustments for Short Straddles Before Expiration :

1. If the underlying asset is expected to fluctuate within a slightly wider range than expected, the position can be closed in favor

of a short strangle position.

2. If the underlying asset moves strongly in one direction, you should buy back the In the Money option quickly in order to

limited losses.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by