"Can Options Delta Move Over 1?"

"Can delta surpass 1.0 due to gamma and for $1 move in the underlying can the option move $1.25 due to delta being over 1.0 overtime?"Asked By Tony Guzman 13 March 2010

The short answer is, No. There is no way the delta value of an option can ever exceed 1 (or -1 for put options) in options trading. I don't think this comes as a surprise to you at all and I suppose what you really want to know is "Why", right?

All long options positions, no matter call option or put option, comes with positive gamma value. Gamma value is the options greek that measures the rate of change of an option's delta value to a change in the price of the underlying stock. Positive gamma value increases the delta value of call options towards 1 and decreases the delta value of put options towards -1 when these options goes more and more in the money.

Since positive delta increases the delta value of options when they go more and more in the money, surely there will come a point where the delta value exceeds 1 or -1, right? Well, this would be true IF gamma value remains unchanged no matter how the price of the underlying stock changes. However, gamma value also changes with the moneyness of an option.

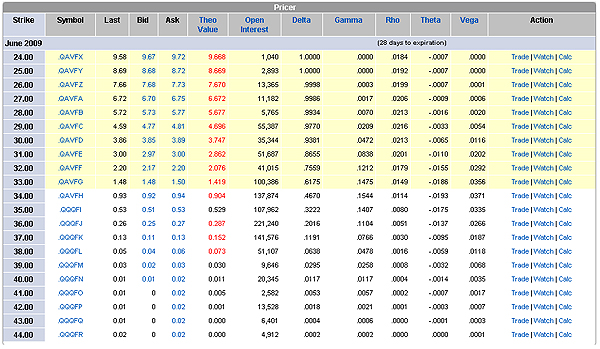

As you can see from the picture above, gamma value decreases as the call options goes more and more in the money. Finally, when the delta value reaches 1.0 at the $25 strike price, gamma value turns to zero as well. This is why you can never have delta of more than 1.

The Delta value of an option is also an indication of the probability that an option will end up in the money by expiration and there is no greater probability than 100%, right?

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by