"Difference In Price Between Different Maturities?"

"Why is there a gap in prices for the same option with different maturities (e.g. one expiring in august and one expiring in december)?"Asked By Marco Presta on 3 July 2010

Answered by Mr. OppiE

Hi Marco Presta,

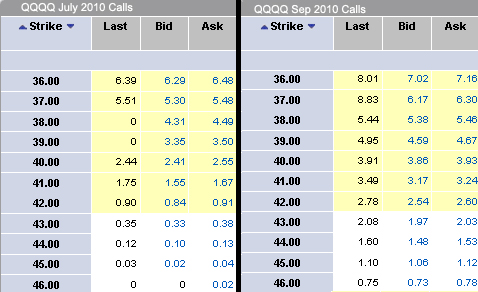

Indeed, when you compare options of the same type, underlying and strike price but with different maturities, prices are different. Let's compare the price difference between July and September call options of QQQQ in the picture of QQQQ's options chain below:

Comparing QQQQ's July and September Call Options

You would notice that September call options across ALL strike prices are more expensive than July call options of the same strike prices. In fact, the price difference is very significant with as high as 39 times difference in price on the far out of the money call options. Why is this so? What justifies such a huge difference in price?

Without going into too much technical details, the reason why options of the same type, underlying and strike price but with different maturities differ in price by so much is due to the concept of "Time Value". Even though the price of options is determined by more than one variable, the variable that made the difference you see in the picture above is what is known as "Time To Expiration". With more time to maturity, time value of an option increases due to the longer term of risk that the writer of the option have to undertake for selling you that option. Time value is the part of the price of the option that typically decreases for the same strike price as time to expiration decreases.

Indeed, time value decreases for options with lesser time to expiration and is also why options you buy become cheaper and cheaper as expiration draws nearer with the underlying stock remaining stagnant. This phenomena is known as "Time Decay".

So, why would anyone choose to buy options with longer maturity that are more expensive when options with shorter maturities at the same strike price could cost so much lesser?

Well, there could be many reasons but the most obvious one is that you simply expect to hold on to your options position for a longer period of time. Perhaps you are trading a trend that could take months to work out which will make buying options of shorter maturity impractical. Moreover, if you keep buying near the money options of shorter maturity and then rolling them forward as each expire for such long trends, you would actually incur much more time value cost than if you had simply bought options with longer maturities.

In conclusion, price difference between options of the same strike price but with different maturities is due mainly to time value of options which increases with time to expiration.

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by