What is time decay in options trading? What is the effects of time decay and how is it calculated?

Time Decay - Definition

The process by which the extrinsic value of an option reduces over the lifetime of the option.

Time Decay - Introduction

"Time Decay" has to be one of the scariest terms that options beginners struggle with as it is associated with loss of value in options trading.

Time decay is a phenomena which works against your favor when you buy stock options. Time decay causes the extrinsic value of options that you buy to diminish as expiration draws nearer such that by expiration, those options would contain no more extrinsic value. Time decay is also the reason why most options holders do not make money if the underlying stock didn't move enough. This tutorial shall explain what Time Decay is and what its role is in options trading.

What is Time Decay of Options?

Time decay, also known as "Premium Decay", is when the extrinsic value (also known as premium value or time value) of an option diminishes as expiration nears. Due to time decay, stock options are classified as "Wasting Assets". In fact, due to time decay a lot of companies are simply classifying options as expenses rather than assets in the first place. In options trading, time decay is the process by which options you bought becomes cheaper and cheaper as time goes by if the underlying stock did not move in expected direction.

If you hold an out of the money option which consists of only extrinsic value and the underlying stock remained stagnant all the way to expiration, you will see the value of those options decrease gradually until its worth zero on expiration day itself. This is what is known as to expire worthless.

Time Decay of Out of The Money Call Options:Assuming stock price = $10, Strike Price = $11 Price of Option on expiration day = $0.00 |

Similarly, if you bought in the money options and the underlying stock remained stagnant, you would see the value of those options decrease gradually until only the intrinsic value is left on expiration day itself. Yes, time decay affects only extrinsic value, not intrinsic value. This is the reason why extrinsic value is sometimes known as "Time Value".

Time Decay of In The Money Call Options:Assuming stock price = $10, Strike Price = $9 Price of Option with 30 days to expiration = $1.30 The $0.30 extrinsic value of this out of the money call option would gradually diminish to zero due to time decay if the stock remained stagnant or remained below $11 by expiration, leaving only the intrinsic value of $1.00. |

As you can see so far, while the holder of an option is waiting for the underlying stock to move in a favorable direction, time decay is eating away at the value of the option. This is why options with significant extrinsic values such as at the money options or out of the money options never move dollar for dollar with the underlying stock. As the stock is moving, time decay is also going against the move by reducing the extrinsic value of its options. It is like trying to swim against the tide such that the stock needs to move enough to beat time decay in order to produce a profit.

Time Decay and Options Delta

As mentioned above, options with significant extrinsic values face the biggest challenge with time decay. Time decay eats away the value of the option even as the underlying stock is moving in your favor.

Time Decay of At The Money Call Options:Assuming stock price = $10, Strike Price = $10 Price of Option with 30 days to expiration = $0.80 If the underlying stock move up by $1 today, the option would only move up by $0.50 as time decay eats back on the extrinsic value of $0.80. The option would now be worth $1.30 with $1.00 of intrinsic value and $0.30 of extrinsic value left. |

The relationship of how much the option would rise with each $1 rise of the underlying stock is governed by the options greek known as Delta. The closer to 1 the delta of an option is, the closer it will move dollar for dollar with the underlying stock. These options usually have extremely low extrinsic value.

Rate of Time Decay

So, how do we tell how fast the value of an option would diminish with time decay? We do that by looking at the options greek known as Theta. Theta tells you the theoretical (mathematical) rate of decline in the price of an option per day. A theta value of -0.05 tells you that the price of that option would likely decline by $0.05 every day.

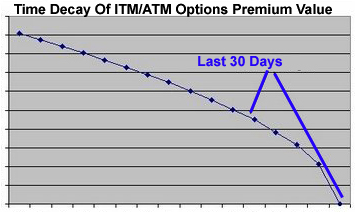

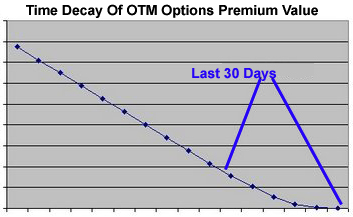

Before you rely on theta to calculate the rate of time decay of your options all the way to their expiration a few months out, you need to take note that theta value of options changes all the time! Yes, this means that the rate of time decay in options trading is not linear. In general, time decay for at the money options and in the money options tends to accelerate in the final 30 days to expiration while time decay for out of the money options tends to decelerate in that final 30 days since there really isn't much more extrinsic value remaining.

Due to this characteristic of time decay, buyers of options typically buy options with much more than 30 days to expiration. This is also why LEAPS options are gaining popularity these days. The rate of time decay is also greatly influenced by implied volatility and when volatility crunch happens, extrinsic value can collaspe overnight.

One point to note here is that in the money options mentioned above refers to in the money options that are near the money. Deeper in the money options with only little extrinsic value left also tend to have lower time decay as expiration approaches even though not as low as out of the money options.

Turning Time Decay into an Ally

While time decay can be a problem to buyers of options, it is truly a friend to writers of options. In fact, options traders favoring credit spreads and naked writes refer to these options trading strategies as "Putting time decay in your favor". Yes, when you are the one writing an option, time decay becomes your friend because time decay is working everyday to put those extrinsic value into your pocket as profit. This is the logic behind the Naked Call Write and Naked Put Write options trading strategy and why writers of options typically write options with lesser than 30 days to expiration.

Options spreads, which are options trading strategies that not only buys options but writes options simultaneously, like the Bull Call Spread, offsets time decay by writing an out of the money call option on top of buying in the money call option. The time decay on the out of the money options in this case compensates for the time decay of the in the money options. This is also why options spreads are most effective only if you hold the position all the way to expiration.

Time Decay isn't Always A Concern

For options traders who buy options in order to hold them to expiration, time decay will not be much of an issue as the whole extrinsic value of the options bought would have been taken into consideration in the calculation of the position's breakeven point. Time decay is a concern only for options traders who intend to close a position before expiration.

Time Decay and Closing a Position EarlyAssuming stock price = $10, Call Option Strike Price = $10 Price of Call Option with 30 days to expiration = $0.80 If you bought these call options with the intention of holding the position all the way to expiration, you would take the whole extrinsic value into calculation for breakeven. This means that you know that the stock needs to move above $10.80 by expiration in order to return a profit. In this case, time decay would not be your concern anymore. All you will be concerned with is whether or not the stock moves above $10.80. |

In fact, all options trading strategies calculate breakeven points by expensing all extrinsic values. As such, it can be said that time decay is not as big a concern for position traders as it is for speculators.

Questions About Time Decay

:: Which Option Has the Fastest Time Decay?

:: How Does Time Decay Work in Credit Spreads?

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by