What Are Call Ratio Spreads in Options Trading?

What Is A Call Ratio Spread?

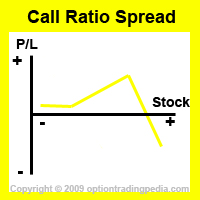

A Call Ratio Spread is a vertical ratio spread with the ability to make a profit in all 3 directions; Upwards, Downwards and Sideways. Yes, all 3 directions!

The Call Ratio Spread and the Put Ratio Spread are the only options trading strategies capable of profiting from all 3 directions all at once, greatly enhancing the probability of win in a trade.

The only way a Call Ratio Spread can lose money is when the underlying stock rallies too strongly. That's right, nothing's perfect in options trading. Because the Call Ratio Spread loses money only when a stock rallies strongly, it has been technically classified as a neutral options strategy even though it does not lose money no matter how much the underlying stock drops.

|

|

When To Use Call Ratio Spread?

Call Ratio Spread should be used when you are confident in a rise in the underlying instrument up to a certain price and wishes to make money even if the stock should remain stagnant or go downwards instead. It is a good options trading strategy to maximise profits on stocks that are expected to hit a technical resistance level.

How to Execute Call Ratio Spreads?

Overview

Call Ratio Spreads are established by shorting more

out of the money call options than the amount of in the money /

at the money call options are bought, resulting in a credit.

Example of Call Ratio Spread:Assuming QQQQ at $44. Buy To Open 4 contracts of QQQQ Jan44Call @ $1.05, Sell To Open 10 contracts of QQQQ Jan45Call @ $0.60 |

In the above example, 10 contracts of out of the money options are shorted while only 4 contracts of at the money call options are bought. The ratio in this Call Ratio Spread is 2.5 : 1. This means that for every 1 contract of at the money call options bought, 2.5 contracts of out of the money call options are sold. This is why such options trading strategies are known as Ratio Spreads. Veteran options traders would notice by now that Call Ratio Spreads are simply Bull Call Spreads that sells more out of the money call options than at the money call options.

How to Determine Ratio and Strike Price to Use For Call Ratio Spread?

Determining the above ratio depends on which strike price the out of the money call options are shorted. In general, the higher the strike price of the out of the money call options, the lower the price of each contract and hence the more contracts need to be shorted in order to result in a net credit, requiring higher margin.

Example of Different Strike Prices Call Ratio Spread:Assuming QQQQ at $44. Jan44Call is trading @ $1.05, Jan45Call is trading @ $0.60, Jan46Call is trading @ $0.25. If the Jan46Call is chosen for shorting instead of the Jan45Call, you would need to short 24 contracts to achieve the net credit of $180 rather than just shorting 10 contracts using the Jan45Call. Below is a comparison: ($0.25 x 2400) - ($1.05 x 400) = $180 credit using the Jan46Call Note: Each options contract represents 100 shares, therefore the figure used in the calculation is the number of contracts times 10. |

The higher the strike price of the out of the money call options shorted in a call ratio spread, the higher the stock can surge before the position starts losing money (the losing point). So the trade off here is really the amount of margin you have versus how far you want the losing point to be. The higher the strike price of the out of the money call options, the farther the losing point of the Call Ratio Spread becomes. Stock options trading is all about trade-offs.

Example of Losing Point in Call Ratio Spread:Assuming QQQQ at $44. Below is a comparison of the losing point between shorting 10 contracts of Jan45Call vs 24 contracts of Jan46Call while long 4 contracts of Jan44Call Shorting 24 contracts of Jan46Call ($0.25 x 2400) - ($1.05 x 400) = $180 credit using the Jan46Call Shorting 10 contracts of Jan45Call ($0.60 x 1000) - ($1.05 x 400) = $180 credit using the Jan45Call Losing point = $45.97 Note: Formula for losing point will be covered below. |

The higher the strike price of the out of the money call options shorted in a Call Ratio Spread, the higher the maximum profit attainable by the Call Ratio Spread will be if the initial net credit is kept the same. However, that also means that the stock needs to rally more in order to attain that maximum profit as the maximum profit attainable by a Call Ratio Spread is when the stock closes on the strike price of the short call options upon expiration. Yes, another options trading trade-off.

Example of Maximum Profit vs Maximum Profit Point in Call Ratio Spread:Assuming QQQQ at $44. Jan44Call is trading @ $1.05, Jan45Call is trading @ $0.60, Jan46Call is trading @ $0.25. Below is a comparison of the maximum profit and maximum profit point between shorting 10 contracts of Jan45Call vs 24 contracts of Jan46Call while long 4 contracts of Jan44Call: Shorting 24 contracts of Jan46Call ($0.25 x 2400) - ($1.05 x 400) = $180 credit using the Jan46Call Maximum Profit = $980, Maximum Profit Point = QQQQ @ $46 Shorting 10 contracts of Jan45Call ($0.60 x 1000) - ($1.05 x 400) = $180 credit using the Jan45Call Maximum Profit = $580, Maximum Profit Point = QQQQ @ $45 Note: Formula for maximum profit will be covered below. |

In an ideal options trading world where margin is not a concern, you would short as many out of the money call options as you want to as far out of the money as possible in order to build a Call Ratio Spread with the highest possible net credit, maximum profit and farthest losing point. However, such a world does not exist in options trading and margin is as big concern a in Call Ratio Spreads as it is in any options trading strategies involving uncovered short option positions.

If you only have enough margin to short a certain number of options contracts, you can either short a lower strike price or you can buy fewer at the money call options in order to maintain the net credit in the Call Ratio Spread. In our Call Ratio Spread examples so far, if you have enough options trading margin to short only 10 contracts, you can use a lower strike price in order to maintain the net credit of the call ratio spread position by choosing the Jan45Call and not the Jan46Call as 10 contracts of Jan46Call would not result in a net credit. Otherwise, you can buy no more than 2 contracts of Jan44Call and still maintain a net credit with 10 contracts of Jan46Call. Such is the flexibility of options trading.

Example of shorting a lower strike price and buying lesser call options in Call Ratio Spread:Assuming QQQQ at $44 and you have enough margin to short only 10 contracts max. Jan44Call is trading @ $1.05, Jan45Call is trading @ $0.60, Jan46Call is trading @ $0.25. Scenario 1: Shorting a Lower Strike. If you can only short 10 contracts of Jan46Call, you won't be able to cover the price of the 4 contracts of Jan44Call bought at all. 4 Contracts of Jan44Call = $1.05 x 400 = $420. 10 contracts of Jan46Call = $0.25 x 1000 = $250. The position would be a net debit of $170 instead of a net credit. When a Call Ratio Spread is a net debit position, it would not be able to make any money if the stock goes down. In this case, you should short the Jan45Calls instead as illustrated in the first example in the overview above. Scenario 2: Buying lesser call options. In order to maintain a net credit while shorting 10 contracts of Jan46Call, you should buy no more than 2 contracts of Jan44Call. 10 contracts of Jan46Call = $0.25 x 1000 = $250 2 contracts of Jan44Call = $1.05 x 200 = $204 Net Credit = $250 - $204 = $46 |

The profitability of a call ratio spread can be enhanced or better guaranteed by legging into the position properly.

Profit Potential of Call Ratio Spread :

The maximum profit potential of a Call Ratio Spread is attained when the underlying stock closes at the strike price of the short call options. In this respect, the profit potential of a Call Ratio Spread is limited.

Maximum profit point of Call Ratio Spread:Assuming QQQQ at $44. Buy To Open 4 contracts of QQQQ Jan44Call @ $1.05, Sell To Open 10 contracts of QQQQ Jan45Call @ $0.60 Maximum Profit happens when the QQQQ closes at $45 at expiration of the Jan45Call. |

Maximum Possible Profit Calculation of Call Ratio Spread:

Maximum Possible Profit = (Total Credit From Short Call Options + [(Difference in strikes - Price of Long Call) x 100 times number of long call contracts])

Profit Calculation of Call Ratio Spread:Assuming QQQQ at $44. Buy To Open 4 contracts of QQQQ Jan44Call @ $1.05, Sell To Open 10 contracts of QQQQ Jan45Call @ $0.60 Max. Return = (0.6 x 1000) + ([(45 - 44) - 1.05] x 400) = $580 |

Risk / Reward of Call Ratio Spread:

Upside Maximum Profit: Limited

Maximum Loss: Unlimited

Position starts losing money if the stock rises past the strike price of the short call options. However, if the stock falls instead of

rises, then the position makes in profit the net credit gained.

Losing Point of Call Ratio Spread:

The losing point of a Call Ratio Spread is the price beyond which the

position starts to go into a loss if the stock continues to go up.

Losing Point: Strike Price of Short Call Options + [Maximum Profit / (number of short call options - number of long call options)]

Losing Point of Call Ratio Spread:Assuming QQQQ at $44. Buy To Open 4 contracts of QQQQ Jan44Call @ $1.05, Sell To Open 10 contracts of QQQQ Jan45Call @ $0.60 Losing Point = 45 + [$5.80 / (10 - 4)] = $45.97 If the QQQQ rises above $45.97, the position will start making an unlimited loss as long as the QQQQ continues to go higher. |

Advantages Of Call Ratio Spread :

Disadvantages Of Call Ratio Spread :

Alternate Actions Before Expiration :

1. When the underlying stock reaches the strike price of the short call options before expiration, one may choose to buy to close the extra short call options and transform the position into a Bull Call Spread in order to prevent losses due to a surge in price past breakeven.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by