How Does The Calendar Call Spread Work in Options Trading?

Calendar Call Spread - Introduction

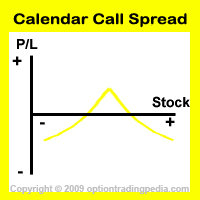

The Calendar Call Spread, being one of the three popular forms of Calendar Spreads (the other 2 being the Calendar Put Spread and the Ratio Calendar Spread), is a neutral options strategy that profits when the underlying stock remains stagnant or trades within a tight price range.

A Calendar Call Spread profits primarily from the difference in rate of premium decay between the near term short options and the long term LEAPs.

This is possible as near term option premiums decay faster than long term option premiums.

|

|

Because the Calendar Call Spread buys LEAPS which are more expensive than the short term options sold, this strategy results in a net debit and is therefore a form of Debit Spread.

(These classifications are only for a deeper understanding of the kinds of option spread strategies and is not necessary for the execution of these strategies.)

When To Use Calendar Call Spread?

One should use a Calendar Call Spread when one wishes to profit from an underlying asset that is expected to stay stagnant or within a tight price range and also wishes to keep a long term call position for if the stock breaks out in future.

How To Use Calendar Call Spread?

Diagonal Calendar Call Spread

In this version of the Calendar Call Spread, all you have to do is to purchase an In the Money (ITM) LEAP and then sell At the Money (ATM) or Out of the Money (OTM) near term calls against the LEAP.

|

Example : Assuming QQQQ trading at $45 now. Buy To Open 10 contracts of QQQQ Jan 2008 $44 Call options at $5.70. Sell To Open 10 contracts of QQQQ Jan 2007 $45 Call at $0.75. |

Read the full tutorial on Diagonal Calendar Call Spread.

In this version of the Calendar Call Spread, you will purchase At The Money (ATM) LEAP call options and then sell ATM near term calls against the LEAP call options.

|

Example : Assuming QQQQ trading at $45 now. Buy To Open 10 contracts of QQQQ Jan 2008 $45 Call options at $4.70. Sell To Open 10 contracts of QQQQ Jan 2007 $45 Call at $0.75. |

Read the full tutorial on Horizontal Calendar Call Spread.

Trading Level Required For Calendar Call Spread

A Level 3 options trading account that allows the execution of debit spreads is needed for the Calendar Call Spread. Read more about Options Account Trading Levels.

Profit Potential of Calendar Call Spread :

Both the Horizontal Calendar Call Spread and Diagonal Calendar Call Spread reaches their maximum profit when the underlying stock closes at the strike price of the short call options during expiration of the short call options.

Profit Calculation of Calendar Call Spread:

The value of a Call Time Spread during expiration of the short call options can only be arrived at using an options pricing model such as the Black-Scholes Model because the expiration value of the long term call options can only be arrived at using such a model.

Risk / Reward of Calendar Call Spread:

Upside Maximum Profit: Limited

Maximum Loss: Limited

(limited to net debit paid)

Break Even Point of Calendar Call Spread:

The breakeven point of a Calendar Call Spread is the point below which the position will start to lose money if the underlying stock rises or falls strongly and can only be calculated using the Black-Scholes model.

Advantages Of Calendar Call Spread:

Disadvantages Of Calendar Call Spread:

Adjustments for Calendar Call Spreads Before Expiration :

1. If you wish to profit from a rally in the underlying asset, you could buy back the short call options before it expires and allow the LEAP Call Options to continue its profit run.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by