How Does The Strip Straddle Work in Options Trading?

Strip Straddle - Introduction

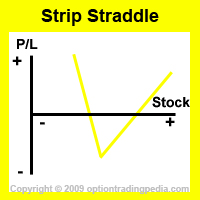

The Strip Straddle, also known simply as a Strip, is a long straddle which buys more put options than call options and has a bearish inclination. As a Volatile Options Strategy, Strip straddles are useful when the direction of a breakout is uncertain but is inclined to downside. Strip straddles can also be used to balance straddles into delta neutral positions. Strip straddles make a higher profit than a regular straddle when the underlying stock breaks downwards but will make a lesser profit than a regular straddle when the underlying stock breaks downwards.

|

|

Main Differences Between Strip Straddle and Regular Long Straddle

The main difference between the Strip Straddle and the regular long straddle is that Strips buys more

put options than

call options. A regular long straddle buys the same number of

at the money put options and call options and has a symmetrical risk graph with equal profit to upside and downside. Strip straddles buy more at the money put options than call options, resulting in a

risk graph with steeper gains to downside than upside. Strip straddles would also have a farther upside breakeven point than downside as the lesser call options need to overcome the premium cost of more put options.

The other purpose of using a Strip straddle is when there are no exactly at the money options available. If the

strike price of the nearest the money options is lesser than the current price of the underlying stock, buying the same amount of call options and put options at the nearest strike price would incline the position to upside. This means that the position makes money more readily to upside than downside as the call options would be in the money. In this case, as the straddle has a positive overall delta value, more put options can be bought to bring the overall

delta of the position back down to zero or near zero. This results in a delta neutral position which profits both ways.

|

Strip Straddle Versus Regular Straddle Example

Assuming QQQQ trading at $43.57. Assuming Jan $43 Call has delta value of 0.75 and Jan $43 Put has delta value of -0.35. Buy To Open 1 contract of Jan $43 Call at $2.38 Buy To Open 1 contract of Jan $43 Put at $1.63. Net Debit = 2.38 + 1.63 = $4.01 Strip Straddle Buy To Open 1 contract of Jan $43 Call at $2.38 Buy To Open 2 contracts of Jan $43 Put at $1.63. Overall Delta = 0.75 - (0.35 x 2) = 0.05 |

The regular straddle can also be given a bullish inclination through buying more call options than put options, creating a Strap Straddle. Strip and Strap are the two variants of the straddle that options traders can use to introduce a bearish or bullish inclination to their straddles.

When To Use Strip Straddle?

One should use a Strip Straddle when one speculates that an uncertain stock might breakout to downside or to create a delta neutral straddle position .

How To Use Strip Straddle?

Buy to Open At The Money (ATM) Call Options and Buy to Open more At The Money (ATM) Put options.

|

Strip Straddle Example

Assuming QQQQ trading at $43.57. Buy To Open 1 contract of Jan $43 Call at $2.38 Buy To Open 2 contracts of Jan $43 Put at $1.63. Net Debit = 2.38 + (1.63 x 2) = $5.64 |

Trading Level Required For Strip Straddle

A Level 2 options trading account that allows the buying of call and put options is needed for the Strip Straddle. Read more about Options Account Trading Levels.

Profit Potential of Strip Straddle :

Strip Straddles have unlimited profit potential as long as the stock continues moving in one direction.

Profit Calculation of Strip Straddle:

Profit = [(Difference between stock price - strike price of strip straddle) x number of call options (if stock is higher) or number of put options (if stock is lower)] - net debit

Maximum Loss = Net debit when stock closes at the options strike price.

|

From the above example :

Assuming QQQQ Drops To $30 Profit = [(43 - 30) x 2] - 5.64 = 26 - 5.64 = $20.36 or 361% Maximum Loss = $5.64 |

Risk / Reward of Strip Straddle:

Upside Maximum Profit: Unlimited

Maximum Loss: Limited

Breakeven Points of Strip Straddle:

A Strip Straddle makes a profit if it goes above its upper breakeven point or below its lower breakeven point.

Upper Breakeven Point = Strike price + net debit

Lower Breakeven Point = Strike price - (net debit/[number of put options/number of call options])

|

From the above example :

Upper Breakeven Point: 43 + 5.64 = $48.64 Lower Breakeven Point: 43 - (5.64/[2/1]) = 43 - 2.82 = $40.18 You would notice at this point that a Strip straddle has a closer lower breakeven point than its upper breakeven point. This is the effect of buying more put options than call options. |

Advantages Of Strip Straddle:

:: Higher profit than a regular straddle if stock breaks out to downside.

:: Closer lower breakeven point.

Disadvantages Of Strip Straddle:

:: Higher minimal cash outlay needed.

:: Higher maximum loss than a regular straddle.

Alternate Actions for Strip Straddles Before Expiration :

1. If the underlying asset has dropped in price and is expected to continue dropping, you could sell to close the call Options and hold the long Put Options.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by