How Does Short Strangle Work in Options Trading?

Short Strangle - Introduction

The Short Strangle, is a very similar option trading strategy to a Short Straddle and is the complete reversal of a Long Strangle. Learning the Long Strangle first makes the Short Strangle easier to understand.

Please Read About The Long Strangle.

|

|

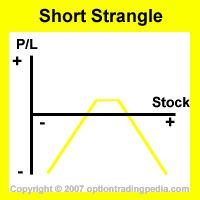

A Long Strangle profits when the underlying asset rallies out of or ditches out of a fixed price range upon expiration. Conversely, a Short Strangle profits

when that underlying asset remains within that fixed price range upon expiration. In this respect, a Short Strangle behaves almost exactly as would a

Short Straddle.

As you recieve money for writing a Short Strangle, it is classified as a Credit Spread. Most other neutral strategies require you to pay

money to put on the trade. Those are known as Debit Spreads. Examples of such Debit Spread neutral strategies that profit when a stock is stagnant would be Butterfly Spreads and Covered Calls.

When To Use Short Strangle?

One should use a short strangle when one is confident that the underlying asset will stay within a tight trading range or stay stagnant until expiration .

How To Use Short Strangle?

Establishing a short strangle simply involves simultaneously selling to open (or writing) an out of the money (OTM) call option and an out of the money (OTM) put option on the underlying asset.

Sell OTM Call + Sell OTM Put

Writing an out of the money call option allows you to profit when the option expires after the underlying stock fails to move above its strike price. Similarly, an out of the money put option allows you to profit when the option expires after underlying stock fails to move lower than its strike price.

Combine them both and you will have a short strangle which profits when the underlying stock neither moves up nor down beyond the strike price of the respective options.

As the out of the money strike prices are further from the prevailing stock price than the at the money options in a Short Straddle, it is a lot easier for a Short Strangle to end up with both legs out of the money, then it is for a Short Straddle to do so. However,

as the out of the money options are cheaper than at the money options, the full profit from a Short Strangle will be lesser than the full profit on a Short Straddle.

|

Short Strangle Example

Assuming QQQQ at $44. Sell To Open QQQQ Jan45Call, sell To Open QQQQ Jan43Put |

Trading Level Required For Short Strangle

A Level 5 options trading account that allows the execution of writing naked options is needed for the Short Strangle. Read more about Options Account Trading Levels.

Profit Potential of Short Strangle :

This strategy reaches full profit potential when both short call and put options expires out of the money.

Profit Calculation of Short Strangle:

% Return = Net Credit � [(Call Strike Price + Put Premium) - Net Credit]

|

Following up on the above example, assuming QQQQ closes at $44.5 at expiration.

Sold to open the JAN 45 Call for $0.80, Sold to open the JAN 43 Put for $0.75 % Return = 1.55 / [($45 + $0.75) - 1.55] = 3.5% profit |

Risk / Reward of Short Strangle:

Maximum Profit: Limited

Net Credit Made On Establishment Of Positions

Maximum Loss: UnLimited

Break Even Point of Short Strangle:

There are 2 break even points to a Short Strangle. One breakeven point if the underlying asset goes up (Upper Breakeven), and one breakeven

point if the underlying asset goes down (Lower Breakeven).

Upper Break Even = Call Strike Price + Net Credit

Lower Break Even = Put Strike Price - Net Credit

|

Following up on the above example:

Upper Break Even = Call Strike Price + Net Credit = $45.00 + $1.55 = $46.55 Lower Break Even = Put Strike Price - Net Credit = $43.00 - $1.55 = $41.45 |

Advantages Of Short Strangle :

:: Able to profit when underlying asset stays stagnant or within a tight trading range.

:: As this is a credit spread position, you are already paid your full profit the moment the position is put on. That reduces risk.

:: Higher chance of ending up in full profit than a short straddle.

:: If the stock remains below the put strike price but above the lower break even the investor will still realize a profit.

:: If the stock remains above the call strike price but below the upper break even the investor will still realize a profit.

:: Since two different OTM strike prices are used, the stock can move in a wider range than in the Short Straddle position and still be profitable.

:: If volatility is high when the position is put on, a drop in volatility after the position is put on can result in a profit.

Disadvantages Of Short Strangle:

:: Lower net credit than the Short Straddle strategy.

:: You can lose more money if the underlying asset swings greatly in one direction beyond either the upper or lower breakeven point.

:: Potential loss is unlimited and can collect to very big amounts if the underlying stock continues strongly in one direction.

:: Because of this risk, the margin requirements for this strategy are fairly high.

Adjustments for Short Strangles Before Expiration :

1. If the underlying asset has moved beyond its breakeven point and is expected to continue to move strongly in the same direction,

one could buy back the In the money option so that some value is recovered from it while allowing the other out of the money option to expire.

2. If it is clear that the underlying stock is moving steadily in one direction, one could buy back the In the Money option and then

buy a corresponding put or call option in order to profit from that move.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by