What Are Call Ratio Backspreads in Options Trading?

Call Ratio Backspread - Introduction

As the name suggests, Call Ratio Backspreads are Ratio Backspreads, which means volatile options strategy.

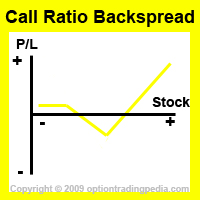

Backspreads profit when the underlying stock breaks out to upside or downside and loses money when the stock remains stagnant. This is what happens with the Call Ratio Backspread but with a slight twist.

Call Ratio Backspreads are credit spreads but retained the unlimited profit potential of debit volatile options trading strategies! Yes, credit backspreads such as the Short Butterfly Spread and Short Condor Spread have only limited profit potential, whereas the Call Ratio Backspread has unlimited profit potential when the stock breaks out to upside and limited profit potential when the stock breaks out to downside, opening up one direction for unlimited profit.

This tutorial shall cover how Call Ratio Backspreads work, when to use it, how to use it and its advantages and disadvantages.

|

|

More a Bullish Strategy than a Volatile Strategy

The Call Ratio Backspread is a

vertical ratio spread. Even though the Call Ratio Backspread is technically a

volatile options trading strategy due to the fact that it can profit either upwards or downwards, it does has a strong directional bias, which is upwards. Yes, Call Ratio Backspreads can be better understood as a bullish options strategy which still makes a limit amount of money even if the stock goes down strongly. It makes an unlimited profit if the stock goes up and a small profit if the stock goes down. Of course, like all bullish options trading strategies, it loses money if the stock stays still. If understood this way, the Call Ratio Backspread becomes the only credit bullish options strategy to have unlimited profit potential. Indeed, the Call Ratio Backspread does empitomize the versatility and flexbility of ratio spreads, creating unique options trading risk/reward profiles.

If the stock is assessed to have a greater chance of breaking out strongly to downside rather than upside, then the Put Ratio Backspread should be used instead in order to open up the downside for unlimited profit.

When To Use Call Ratio Backspread?

One should use a Call Ratio Backspread when one is confident in a strong rise in the underlying instrument , wishes to profit from that rise without any upfront payment and not lose any money should the stock falls .

How To Execute Call Ratio Backspread?

The Call Ratio Backspread involves buying more at the money or out of the money call options than the number of in the money call options are shorted.

Call Ratio Backspread Example:Assuming QQQQ at $44.

|

The ratio of long and short call options depends largely on the preference of the individual trader. A common ratio is the 2 : 1 ratio spread where you sell to open 1 In The Money (ITM) call option for every 2 At The Money (ATM) or Out of the Money (OTM) call options that was bought.

What Strike Prices To Use In Call Ratio Backspread?

The main deciding factor when determining what ratio

to establish the Call Ratio Backspread with is strike price. Here are the effects of different strike prices being used :

1. The wider the strike price difference between the short and long call options, the lesser In The Money (ITM) call options you would need to

sell in order to cover the price of the long call options, the bigger the profit if the stock goes down but the further the lower breakeven point becomes.

From the guidelines above, it is obvious that the higher we expect the net credit to be, the lower the stock needs to drop in order to profit to downside. This is the kind of compromise every options traders should be familar with in options trading. As such, we should always choose to sell the nearest in the money (ITM) call options which covers the total price of the long call options without exceeding the number of long call options bought.

STOCK PICK MASTER!

"Probably The Most Accurate Stock Picks In The World..."

Profit Potential of Call Ratio Backspread :

The Call Ratio Backspread has an unlimited profit potential to upside and will keep making more profit as long as the underlying stock keeps rising. It also has limit profit potential to downside and will make the net credit as profit if the stock drops below the lower breakeven point.

Profit Calculation of Call Ratio Backspread:

Profit = (Profit on Long Calls) - (Loss on Short Calls)

Profit Calculation of Call Ratio Backspread:Assuming QQQQ at $44. Buy To Open 2 QQQQ Jan44Call @ $1.05, Sell To Open 1 QQQQ Jan41Call @ $3.15. Assume QQQQ rises to $50 during expiration. Because you paid nothing to put on this position, profit % is infinite. You made money out of nothing. |

Maximum loss = Intrinsic Value of short call options - total credit recieved

Maximum Loss Calculation of Call Ratio Backspread:Assuming QQQQ at $44. Buy To Open 2 QQQQ Jan44Call @ $1.05, Sell To Open 1 QQQQ Jan41Call @ $3.15. Maximum Loss = $300 - $105 = $195 |

<3>Risk / Reward of Call Ratio Backspread:

Upside Maximum Profit: Unlimited

Maximum Loss: limited

Maximum loss occurs when the underlying stock closes exactly at the strike price of the Long Call Options.

Break Even Point of Call Ratio Backspread:

There are 2 breakeven points for a Call Ratio Backspread. The Upper Breakeven Point is point above which the position will start

to make a profit. The Lower Breakeven Point is the point below which the position will make in profit the net credit received.

Upper Breakeven Point = long call strike + (number of contracts sold x Difference Between Strike) - net credit

Upper Breakeven Point Calculation of Call Ratio Backspread:Assuming QQQQ at $44. Buy To Open 2 contracts of QQQQ Jan44Call @ $1.05, Sell To Open 1 contract of QQQQ Jan41Call @ $3.15. Net credit = $105 Upper Breakeven Point = 44 + (1 x 3) - 1.05 = $45.95 |

Lower Breakeven Point = strike price of short call + (net credit / contracts sold)

Lower Breakeven Calculation of Call Ratio Backspread:Continuing from the previous example: Lower Breakeven Point = 41 + (1.05 / 1) = $42.05 If the stock drops below $42.05, it will start to make a profit with maximum profit attainable as net credit received. |

As you noticed from above, the Call Ratio Backspread offers the best of both worlds as long as the underlying stock moves significantly up or down.

As you noticed from above, the Call Ratio Backspread offers the best of both worlds as long as the underlying stock moves significantly up or down.

|

Advantages Of Call Ratio Backspread :

Disadvantages Of Call Ratio Backspread :

Alternate Actions Before Expiration :

1. If the position is already in profit and the underlying stock is expected to continue it's rally, you could

buy to close the

short call options, transforming the position into a Long Call Option

in order to maximise profits.

2. If the position is in profit and the underlying stock is expected to reach a certain price by expiration or stay stagnant at a certain higher price,

one could buy to close the short call options and then sell to open call options at the strike price which the underlying stock is expected to rise to. This

transforms the position into a Bull Call Spread.

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by