How Does The Long Put Option Work in Options Trading?

Long Put Options - Introduction

Buying Put options, or also known as Long Put Options or simply Long Put, is the simplest bearish option strategy ever.

Many beginner option traders find it mentally challenging to Buy Put Options or Long Put Options as profiting when a stock goes down is something which is

unfamilar and often preceived as risky in the stock trading world.

|

|

Buying Put Options / Long Put Options truly opened up, for the first time in trading history, the ability to "invest" in a downwards move with limited risk and unlimited profit potential. Here's how Buying Put Options / Long Put Options compares to shorting stocks and futures :

| Method | Margin | Max Loss | Max Profit |

| Buying Put Options | No | Low | High |

| Shorting Stocks | Yes | High | Low |

| Shorting Futures | Yes | Highest | Highest |

As you can see from the table above, Buying Put Options / Long Put Options gives a trader the most favorable reward/risk balance when

trading a downwards move in an underlying stock.

One should be familar with Put options before executing this strategy. Please read all about Put options here.

When To Buy Put Options / Long Put Options?

Buying Put Options / Long Put Options is an extremely versatile option strategy where one can use when:

1. Confident of a significant drop in the underlying stock

As explained above, Buying Put Options / Long Put Options is the most direct, safe and profitable way of profiting from a

drop in the underlying stock.

2. Wants to hedge one's stock against a drop in price

Buying Put Options / Long Put Options is not only good as a leverage tool but also as a hedging tool. This is known as a

"Married Put" or "Protective Put".

How To Buy Put Options / Long Put Options?

There are actually 2 ways to execute a buy Put options / Long Put Options strategy... I shall simply refer to them as the Beginner way and the Veteran Way.

The beginner way to buying Put options / Long Put Options is simply to buy At The Money (ATM) Put options of the stock you think is going to go down.

| Example : Assuming QQQQ at $44. Buy To Open 10 QQQQ Jan44Put. |

The Veteran Way To Buying Put Options / Long Put Options

Veterans buying Put options / Long Put Options need to consider delta values and strike prices when choosing what specific strike price to buy the

Put options at in order to fulfill one's investment and portfolio needs.

Veteran Option Trader Method 1 : Veterans expecting a quick and dramatic drop in the underlying stock beyond a certain price could maximise profit potential by buying Out of The Money (OTM) Put options at a strike price which one is sure that the underlying stock would drop below.

|

Example : Assuming QQQQ at $44. Veteran expects QQQQ to drop quickly to $40. Veteran buys to open 10 Jan$42Put. |

In this case, QQQQ needs to drop below $42 to turn in a profit by expiration. If QQQQ drops but not to below $42, the Put options would be worthless by expiration. If QQQQ drops before expiration but not beyond $42, one could still turn in a profit based on the delta value of the Put options. In fact, veteran option traders rarely hold a stock option contract to expiration. This is also the buying Put options / Long Put Options method that will turn the highest profit in percentage but comes also with the highest risk of loss.

Veteran Option Trader Method 2 : Veterans expecting the underlying stock to drop moderately and wishes to maximise profits would buy In The Money (ITM) Options as ITM options contains higher delta value than At The Money Options.

|

Example : Assuming QQQQ at $44. Veteran expects QQQQ to rise moderately. Veteran buys to open 10 Jan$45Put. |

How deep In The Money (ITM) to buy the Put options at is really up to the trade management need of the individual but in essence, one would not go lower than the first strike price that turns in a delta value of -1 or -0.99. This method of buying Put options / Long Put Options is less risky as one would still have some value left over at expiration if the underlying stock stayed stagnant. It will however turn in less profit per cent then the Out of the money (OTM) method above.

Here is a table explaining the differences between the 3 methods discussed above:

| Assume QQQQ Drops From $44 To $40. | |||||||

| Method | Price | Delta | Profit Before Expiration | Profit @ Expiration | Loss If QQQQ Expires @ $44 | Risk Ranking | Profit Ranking |

| Beginner Way | $0.80 | -0.5 | +250% | +400% | -100% | 2 | 2 |

| Veteran Method 1 | $0.10 | -0.159 | +636% | +1900% | -100% | 1 | 1 |

| Veteran Method 2 | $1.80 | -0.862 | +191.55% | +177.77% | -44.4% | 3 | 3 |

Please note that the above figures for Profit Before Expiration are only arbituary and that precise calculation of expected profit before expiration can only be arrived at

using a stock option pricing model such as the Black Scholes Model.

That is because delta value increases as a Put option gets more and more in the money.

Please note that the above figures for Profit Before Expiration are only arbituary and that precise calculation of expected profit before expiration can only be arrived at

using a stock option pricing model such as the Black Scholes Model.

That is because delta value increases as a Put option gets more and more in the money.

|

It's clear from the above table that no matter what method of Buying Put Options / Long Put Options you choose to execute, you will always end up with more profit per cent than simply shorting QQQQ. A trader who simply short QQQQ stocks at $44 would only make 9% profit when QQQQ drops to $40. The Options Leverage involved in using each of the above methods can also be mathematically measured to help make a more informed decision when buying call options.

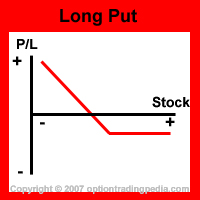

Profit Potential of Buying Put Options / Long Put Options :

Buying Put options / Long Put Options allows you to profit with unlimited ceiling. That means that your profit grows as long as the underlying stock continues to drop, unlike other more complex strategies like the Bear Put Spread where the position stops making money after the underlying stock drops to a certain level. In this sense, Buying Put Options / Long Put Options is one of the few option strategies that has unlimited profit potential.

Trading Level Required For Buying Put Options

A Level 2 options trading account that allows the buying of call and put options without first owning the underlying stock is needed for buying put options. Read more about Options Account Trading Levels.

Profit Calculation of Buying Put Options / Long Put Options :

There are 2 ways to calculate profit for Long Put Options : Before Expiration and After Expiration.

Before Expiration

One can predict the rise in the value of the Put options for every $1 drop in the underlying stock using the delta value of the

Put option, and hence it's profit.

|

Following up from the above example:

Buy to open 10 QQQQ Jan44Put for $0.80 per contract. QQQQ drops to $40 the next day. Delta value of Jan44Put is -0.5. (please leave out the "-" sign during calculation. Profit = [(drop in underlying stock) x delta value] / price of Put options |

Please note that the above figures are only arbituary and that precise calculation of expected profit before expiration can only be arrived at

using a stock option pricing model such as the Black Scholes Model.

That is because delta value increases as a Put option gets more and more in the money.

Please note that the above figures are only arbituary and that precise calculation of expected profit before expiration can only be arrived at

using a stock option pricing model such as the Black Scholes Model.

That is because delta value increases as a Put option gets more and more in the money.

|

After Expiration

Upon expiration, Put options will be left with the value of the stock below it's strike price. If that value is higher than

the original premium value of the Put options, the position turns a profit. ( Read

About How To Calculate Premium Value Of An Option Here )

|

Following up from the above example:

Buy to open 10 QQQQ Jan44Put for $0.80 per contract. QQQQ drops to $40 at expiration. Profit = [(Strike Price - Price of Underlying Stock) - premium value of Put options] / Price of Put Options |

Risk / Reward of Buying Put Options / Long Put Options:

Upside Maximum Profit: Unlimited

Maximum Loss: Limited

Net Debit Paid. The most one could lose is the entire amount put forward into buying Put options when the underlying stock expires out of the money (OTM).

Break Even Point of Buying Put Options / Long Put Options:

Again, there are 2 ways to determine break even point for buying Put options / long Put options. Before Expiration and After Expiration.

Before Expiration

Before expiration, the bid/ask spread of the Put options

is the breakeven point.

|

Following up from the above example:

QQQQ Jan44Put has a bid price of $0.78 and an ask price of $0.80. Because one buy at the ask price and sell at the bid price, the difference of $0.02 becomes the breakeven point beyond which one would start to profit. |

After Expiration

After expiration, the underlying stock needs to move more than the premium value in the Put option in order to result in a profit.

Thus the breakeven point becomes the entire premium value of the Put option.

|

Following up from the above example:

QQQQ Jan44Put is At The Money and has no intrinsic value. The whole price of $0.80 is premium value. Thus the breakeven point would be $44 + $0.80 = $44.80. QQQQ needs to move more than $44.80 by expiration in order to result in a profit. |

Advantages Of Buying Put Options / Long Put Options:

:: Loss is limited if the underlying financial instrument rises instead of fall. This allows one to risk little money for the same moves in the underlying stock versus using other instruments like futures.

:: It allows traders with different risk appetite and portfolio management strategy to pick Put options with strike prices and delta values that fulfills that trading objective.

:: It is the most basic option strategy where an option trader could simply transform into other option strategies in order to hedge one's position by buying or selling more options.

:: It is a simple option strategy which requires no precise calculation to execute, unlike other complex option strategies.

:: As it involves buying only one kind of option, the commissions involved would be much lower than the rest of the other complex option strategies.

:: As buying Put options / long Put options do not involve margin, unlike in a short Put option strategy, literally any beginner option trader can execute this simple option strategy.

Disadvantages Of Buying Put Options / Long Put Options:

:: There is the danger which you could lose all your money if you use all your money into this strategy and then the underlying stock

rises instead of falls, expiring the Put options out of the money.

:: Put option premium is subjected to time decay, so the

value of the option actually depreciates daily until expiration. However, this is not a concern if one intends to hold the Put options all the

way to expiration.

Adjustments for Buying Put Options / Long Put Options Before Expiration :

1. If the underlying stock is expected to slow down its decline or halt by a certain price, one could sell to open a corresponding

amount of out of the money Put options, transforming the position into a Bear Put Spread,

in order to reap an additional profit or to hedge against a small pullup in the price of the

underlying stock.

2. Alternatively, if one wishes to protect the profits in one's position, one could place a delta neutral hedge.

3. If the underlying stock proves to be very volatile and moves up and down in big swings, then one could buy a corresponding number of put options

and transform the position from a long Put option into a long strangle where one can profit no matter if the stock expires higher or lower.

Alternate Actions for Buying Put Options / Long Put Options During Expiration :

1. Exercise the Put options. One could exercise the Put option if it is In The Money in order to sell the stock at better than market

price. One would normally do this only if one is already holding the underlying stock.

2. Sell the Put options. This is the most popular choice of option traders. Simply sell the Put option and realise the profits so far.

3. Roll the position forward. If one continues to be bearish on the underlying stock, one could perform what we call a rolling forward.

This is a simple procedure where one sells the expiring Put options and buy Put options of the following month.

Questions on Buying Put Options

:: "Does My OTM Put Profit Before Strike Price Is Reached?"

:: How Do I Get Good Stocks To Buy Put Options On?

Videos On Buying Put Options

Video: AAPL Long Put |

Video: AAPL Naked Put Write |

|

Don't Know If This Is The Right Option Strategy For You? Try our Option Strategy Selector! |

| Javascript Tree Menu |

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by