Profiting from the same move with much lesser risk

Fiduciary Calls - Definition

Fiduciary Call is an option trading strategy which buys call options as a replacement for a protective put or married put in the same proportion.

Fiduciary Calls - Introduction

A Fiduciary Call is a means of reducing and controlling losses using options rather than stocks. Yes, trading options can be safer than stocks if you are employing the Fiduciary call strategy. What this options strategy means is simply, to control the same amount of stocks using call options as you would have if you had bought the shares directly. Insteading of buying 100 shares of a stock using all your money, you simply buy 1 contract of its call options (1 contract represents 100 shares) with just a small fraction of the money and put the rest of the cash into an interest bearing risk free investment vehicle, thereby increasing your overall profits and reducing your maximum risk exposure to just the amount of money you used towards buying the call options.

Fiduciary Calls - Relationship With Protective Put

A Married Put or a Protective Put option trading strategy is where you buy put options in order to protect your stock from losses beyond the strike price of the put options. To do this, you pay the price of the put options, like an insurance premium, monthly. In this case, the put options perform like an insurance. If you are familiar with the protective put options strategy, the Fiduciary Call actually is a way of getting the exact same payoff profile with much lesser cash.

Fiduciary Calls vs Protective Put ExampleAssuming MSFT is trading at $30 per share, its November $30 Call Option is trading at $0.80 and November $30 Put Option is trading at $0.80. Assuming you own 100 MSFT shares at $30 per share. You buy 1 contract of MSFT Nov30Put for $0.80. Total cost of position = ($30 x 100) + ($0.8 x 100) = $3080. Fiduciary Call You buy one contract of MSFT Nov30Call for $0.80. Total cost of position = ($0.80 x 100) = $80. |

The protective put position in the example above costs $3,080 to put on. However, there is a cheaper way to get exactly the same potential payoff profile and that is by using a Fiduciary Call.

A Fiduciary Call is simply the buying of enough At The Money call options to represent the total amount of shares that would be bought. In this case, a Fiduciary Call requires the buying of only 1 contract of MSFT Nov30Call for $80 (Assume Nov30Call = $0.80).

Through buying a Fiduciary Call, the rest of the fund that would have been otherwise committed to a protective put position can be reinvested in a risk free instrument, thus returning more overall profit than a protective put position. In essence, a protective put creates a synthetic call position.

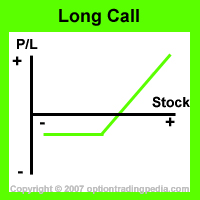

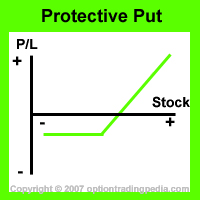

Fiduciary Calls - Risk Graph Comparison

Comparing the option trading risk graph of the Fiduciary Call (call option) and a Protective Put, you would notice that they are exactly the same. Same loss if the stock stays stagnant, same profit profile and same limited loss.

Fiduciary Calls - Data Comparison

The table below perfectly explains the benefits of a Fiduciary Call, using the above MSFT example.

| Fiduciary Call | Protective Put | |

| Cost | $80 | $3080 |

| Profit If MSFT $50 | $1920* | $1920** |

| Loss If MSFT $10 | $80` | $80`` |

| Fund Committed*** | 1.6% | 61.6% |

** : ((Present Stock Price - Initial Stock Price) x number of shares) - net option premium

*** : Assuming a total fund size of $5000

` : Net option premium

`` : ((Initial Stock Price - Strike Price of Put) x number of shares) + Net option premium

(if put options are ITM, maximum loss is the net extrinsic value of the put options)

Clearly, using a Fiduciary Call returns the exact same profit, has the exact same loss but utilises only a small fraction of the price of a protective put position through the principle of Put Call Parity. This also means that a stock combined with a put option creates a synthetic call option. In order for a Fiduciary Call to return the exact same profit/loss profile, leverage must be controlled such that no additional MSFT shares or options are bought using the remaining fund. The remaining fund should be held in a fiduciary account which returns a risk free interest rate in order to safely return an additional profit to the overall fund. Hence the term "Fiduciary". This is also what makes the famous Stock Replacement Strategy possible.

However, having both the put options and call options at the money at the same time and with perfect put call parity is a rarity. Most of the time, the stock would be several cents or dollars in the money on one side and out of the money on the other side. In this case, the Fiduciary Call may not return the same profile as the Protective Put if near the money options (NTM) are used in both cases.

NTM Fiduciary Calls vs NTM Protective Put ExampleAssuming MSFT is trading at $30.50 per share, its November $30 Call Option, which is slightly in the money, is trading at $0.90 and November $30 Put Option, which is slightly out of the money, is trading at $0.70. Assuming you own 100 MSFT shares at $30.50 per share. You buy 1 contract of MSFT Nov30Put for $0.70. Total cost of position = ($30.50 x 100) + ($0.7 x 100) = $3120. Fiduciary Call You buy one contract of MSFT Nov30Call for $0.90. Total cost of position = ($0.90 x 100) = $90. |

The resulting profit and loss at $50 and $10 becomes:

| Fiduciary Call | Protective Put | |

| Cost | $90 | $3120 |

| Profit If MSFT $50 | $1910* | $1880** |

| Loss If MSFT $10 | $90` | $120`` |

| Fund Committed*** | 1.8% | 62.4% |

In this case, using a Fiduciary Call is clearly more beneficial than a Protective Put as the Fiduciary Call requires lesser capital, returns a higher profit and a lower loss. As such, options traders should make careful calculation to see what works best in each specific situation.

Fiduciary Calls - Conclusion

You must be wondering by now, what's the difference between a "Fiduciary Call" and a plain vanilla "Long Call" option trading strategy? Well, there really isn't any difference since both option trading strategies involves just buying call options. The main difference is in the number of call options purchased and the purpose behind the purchase. Just like people eat at a restaurant over more reasons then just ridding one of hunger, the different purpose behind executing each strategy changes the nature of each option trading strategy. Long ago, when there was only call options and no put options being traded in the exchanges, investors "manufactured" put options for the protection of a portfolio through the use of Fiduciary Calls, governed by the principle of Put-Call Parity.

Important Disclaimer : Options involve risk and are not suitable for all investors. Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning : All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be copied, redistributed or downloaded in any ways unless in accordance with our quoting policy. We have a comprehensive system to detect plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by