Stock Replacement Strategy

|

|

|

|

|

Stock Replacement Strategy - Definition

A trading strategy that involves replacing the purchase of stocks with the purchase of its deep in the money call options so that

more cash is retained in an account for hedging purpose.

Stock Replacement Strategy - Introduction

The Stock Replacement Strategy is an

options trading

strategy that have been around for decades and recently made popular (2007) by the

host of CNBC's Mad Money program, Jim Cramer. It is an

options strategy that can be both simple and complex with

the versatility to cater to the needs of amateur options traders and professional options traders. The main purpose

of the Stock Replacement Strategy is the reduction of overall portfolio risk through the replacement of stocks using deep in the money call options

and then using the remaining cash for strategic hedging as the trade progresses. We will cover both the

simple and complex (full) version of the Stock Replacement Strategy in this tutorial.

|

When Should You Use The Stock Replacement Strategy?

You use the stock replacement strategy when you want to limit downside risk while retaining the full benefits of stock appreciation.

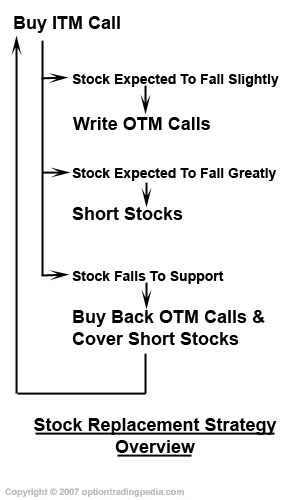

Overview Of The Stock Replacement Strategy

The stock replacement strategy is a two part strategy consisting of the initial position and the hedging trades. The flow chart below

explains the components of the stock replacement strategy.

Stock Replacement Strategy - Initial Position

The Stock Replacement Strategy is an options trading strategy made possible through the leverage effects of

stock options.

The Stock Replacement Strategy establishes initial position by buying deep in the money

call options with at least 3 months to expiration

(so that the underlying stock have enough time to move. In fact, longer term options can be used as well) representing the

same amount of stocks

that would otherwise be bought. Up to this part, we are in fact establishing a

Fiduciary Call strategy using deep

in the money options.

Stock Replacement Strategy Example

Initial Position

Assuming you have $5000 to invest in stocks of XYZ company trading at $50. XYZ company's $25 strike price call options are asking at $25.10.

Instead of buying 100 shares using all your money, you would own the rights to the same 100 shares by buying 100 contracts (1 lot) of the $25 strike price call options

for only $2510. At this point, your maximum risk is only $2510 instead of $5000.

|

Deep in the money call options have

delta value of 1 or very close to 1,

allowing them to rise dollar for dollar with the underlying stock.

This makes deep in the money options the perfect replacement for the underlying stocks and is also it

is known as a Stock Replacement Strategy. Deep in the money options essentially allows you to "own" the stocks at a big discount, thereby

limiting downside risk as the maximum loss you can suffer is the amount that went into paying for the options.

Stock Replacement Strategy Example

If Stock Takes A Big Fall

Assuming stocks of XYZ company takes a surprise drop from $50 to $15 within a month.

If you owned the stocks, you would have lost $5000 - $1500 = $3500

If you used the Stock Replacement Strategy, you would have lost only $2510.

|

Deep in the money options also appreciates dollar for dollar with the underlying stock, greatly enhancing your ROI since the capital

outlay is significantly lower.

Stock Replacement Strategy Example

If Stock Rises

Assuming stocks of XYZ company rises to $70 from $50 within a month.

If you owned the stocks, you would have made $7000 - $5000 = $2000, which is a 40% profit.

If you used the Stock Replacement Strategy, you would have made $4510 - $2510 = $2000, which is a 79.7% profit!

|

There are already 3 important benefits achieved at this stage:

1. Full benefit of stock appreciation is retained.

2. Maximum possible loss is greatly limited.

3. ROI is greatly enhanced.

Up to this point, amateur options traders who are not skilled in

hedging

simply put on the initial position as a risk limited way of owning the

stocks. This is what many options traders refer to as the simple version of the Stock Replacement Strategy.

Stock Replacement Strategy - The Complex Bit

|

Beginner options traders should halt at this point to avoid confusion.

|

Here is where the complex bit of the Stock Replacement Strategy starts. Cash freed up from owning the options and not the stocks comes into play

from this point onwards in order to hedge the position during various stages of the trade. Hedging in the Stock Replacement Strategy is highly

discretionary and without fixed levels or formulas.

The type of hedge to be used and when it should be used depends solely on your analysis

of the stock action especially at resistance and support levels

and is most suitable for experienced

swing traders.

That's why this phase of the Stock Replacement Strategy is something which

should not be

taken lightly by beginners or amateurs.

Let's remember that the goal of the Stock Replacement Strategy is the reduction of risk and volatility through strategic hedging.

If the stock is bought outright, no cash is left for hedging, leaving the position vulnerable to a lot of volatility as it is free to go down

as easily as it can go up. By hedging the position when it goes up or down, especially at resistance or support levels, position volatility is

reduced as potential losses are limited at the cost of a little profit.

There are 2 main hedging techniques in the Stock Replacement Strategy:

1. OTM Call Writing : For moderate corrections

2. Stock Shorting : For significant corrections

OTM Call Writing

Writing

out of the money (OTM)

call options against the existing calls in the Stock Replacement Strategy creates a

bull call spread which provides

protection against the stock moving sideways or correcting downwards slightly even though

maximum upside potential becomes limited. Writing OTM call options keeps the Stock Replacement Strategy

position delta

positive and converts the

position theta

to positive as well. This allows the Stock Replacement Strategy position to continue to profit if the stock moves upwards

as well as if the stock remains stagnant due to

time decay

of the out of the money call options. In fact, this hedge is best applied when the

stock is expected to stay below the strike price of the otm call options for a significant amount of time so that it may be closed for a

profit should the stock resume its uptrend later.

As the stock replacement strategy writes the same

number of otm call options as there are deep in the money call options, no margin is required.

You would conduct this stage of hedging when the stock approaches a short term resistance level and is expected to pullback slightly.

Stock Replacement Strategy Example

Writing OTM Call Options

Assuming stocks of XYZ company rises to $60, which is assessed to be a strong resistance level.

You own 100 contracts of XYZ $25 strike call options which are now valued at $35.05 and you wish to apply the OTM call writing hedge to

partially protect the profits so far and also to make a further profit if the stock remains stagnant.

You

sell to open

100 contracts of XYZ $70 strike call options which are now valued at $5.00.

You are now protected such that if the stock falls to $55, the position loses nothing due to the $5.00 gained from the sale of the otm call options.

Your potential profit is also enhanced if the stock rises up to the $70 mark where you not only make the capital gain from the long call options

but also the premium gained from the short call options.

|

The effect of this hedge is that it reduces the position delta value, reducing the potential profit of the position if the stock goes up

and the loss if the stock goes down. This effectively reduces the volatility of the position relative to the underlying stock.

Stock Replacement Strategy Example

Effect On Position Delta

Here's how the delta value of the position look like after applying the otm hedge in the previous example:

100 Long $25 Call Options : 100 delta

100 Short $70 Call Options : -25 delta

Overall position delta = 100 - 25 = 75 delta

Instead of making $100 if the stock goes up by $1, the position is now capable of making only $75 if the stock goes up by $1. That's the

trade-off for having the protection in place. A little profit for a lot better sleep at night. Conversely, this also mean that the position's

sensitivity to a drop in the stock becomes reduced as well! When the stock falls by $1, instead of losing $100, the position loses only $75!

This is what a reduction in position volatility means. Having a lower position delta, lowers the sensitivity of the position to changes in the

underlying stock thus reducing the volatility of the position relative to the stock.

|

If the resistance level is broken and the stock is expected to continue rising, the otm call options are to be bought back in order to

restore the delta value of the position back to its pre-hedged level and maximize profits.

Buying back the otm call options after the stock starts rising may result in having to pay a slightly higher price than you

sold it for, that is why you need cash in the account to perform this stage of the stock replacement strategy.

Stock Shorting

If the stock is expected to take a significant correction, the stock shorting method should be used either on its own or in conjunction with

writing the otm call options. There is only one purpose for shorting the stock and that is to completely protect the

Stock Replacement Strategy position.

Shorting the stock allows the delta value to be hedged to an absolute zero, converting the stock replacement strategy position into a

delta neutral position

which is capable of not only protecting the profits made in the position so far but also to continue profiting should the

stock take a significant and prolonged plunge.

To execute this hedging technique, simply short as many shares of the underlying stock as the delta value of the position to be hedged.

Stock Replacement Strategy Example

Stock Shorting

Assuming stocks of XYZ company rises to $60, which is assessed to be a strong resistance level and that the stock is expected to take a big fall.

You own 100 contracts of XYZ $25 strike call options which are now valued at $35.05 and you wish to apply the stock shorting hedge to

fully protect the profits so far and also to make a further profit if the stock falls significantly.

The delta value of your position is 100.

You will short 100 shares XYZ stocks to fully hedge the position to delta neutral.

From this point forward, with the position at delta neutral, the value of the position will not change no matter how the stock moves above the

strike price of the deep in the money call options, which in this case is $25, as all losses in the options will be offset by gains in the

short stock and losses in the short stock are also fully offset by gains in the options.

Furthermore, if the

stock falls drastically below the strike price of the deep in the money calls, the position will continue to profit as the short stock falls

further.

Assuming stocks of XYZ company falls by $20 to $40.

100 contracts of $25 strike call options : $1500

Short 100 shares of XYZ stocks : + $2000 ($20 x 100)

Total position value : $3500

Your position value moved from $3505 to $3500 due to premium decay even though stock dropped from $60 to $20. The position value have been

almost completely protected.

|

This stock replacement strategy hedging technique

can also be used in conjunction with writing otm calls, especially when the stock fails at the resistance level and is

expected to fall significantly. To do this, you simply

short

as many shares of the stock as the remaining delta value of the position.

Stock Replacement Strategy Example

Writing OTM Call Options + Shorting Stocks

Assuming stocks of XYZ company rises to $60, which is assessed to be a strong resistance level.

You own 100 contracts of XYZ $25 strike call options which are now valued at $35.05 and you wish to apply the OTM call writing hedge to

partially protect the profits so far and also to make a further profit if the stock remains stagnant.

You sell to open 100 contracts of XYZ $70 strike call options which are now valued at $5.00.

You are now protected such that if the stock falls to $55, the position loses nothing due to the $5.00 gained from the sale of the otm call options.

Your potential profit is also enhanced if the stock rises up to the $70 mark where you not only make the capital gain from the long call options

but also the premium gained from the short call options.

Assuming stocks of XYZ company fails at the resistance level, falls to $55 and is expected to fall further.

The position has a delta value of 75 as explained in the previous example. You simply short 75 shares of XYZ company stocks to complete the

delta neutral hedge.

From this point forward, your stock replacement strategy position will consist of 100 contracts of $25 strike call options, short 100 contracts

of $70 strike call options and short 75 shares of XYZ stocks.

Assuming stocks of XYZ company falls by $20 to $40.

100 contracts of $25 strike call options : $1500

Short 100 contracts of $70 strike call options : + $500 ($5.00 x 100)

Short 75 shares of XYZ stocks : + $1500 ($20 x 75)

Total position value : $3500

|

Stock Replacement Strategy - Unhedging

So, after the hedges are in place and the stock drops back down to a strong support level, you would already be able to sell the hedges

at a profit and then let the deep in the money options rise again to the next resistance level. This way, you would be able to make

a handsome profit even if the stock simply oscillated within a range. That is the real magic of the Stock Replacement Strategy.

Protecting your profits on the way down and leveraging your way up.

Stock Replacement Strategy Example

Stock Shorting

Assuming stocks of XYZ company falls by $20 to $40.

100 contracts of $25 strike call options : $1500

Short 100 shares of XYZ stocks : + $2000 ($20 x 100)

Total position value : $3500

Your position value moved from $3505 to $3500 due to premium decay even though stock dropped from $60 to $20. The position value have been

almost completely protected.

Assuming $40 is assessed to be a strong support level,

you simply unhedge the position by covering the short stock position.

After covering the short stock position, your portfolio would be:

100 contracts of $25 strike call options valued @ $1500 and cash of $2000 from closing the short stocks.

With the cash of $2000, you could buy more of the $25 strike call options so that you can further leverage your profits on the way up.

|

Advantages Of Stock Replacement Strategy

1. Reduction of maximum possible loss through replacing owning the stock with owning the options instead.

2. Reduction of portfolio volatility through strategic hedging under various resistance levels.

3. Increasing profitability through strategic unhedging at support.

Disadvantages of Stock Replacement Strategy

1. Requires a high level of technical analysis skill to identify areas of resistance and support.

2. Significant profits can be lost if hedging is done at the wrong areas.

|

|

|

|

Important Disclaimer :

Options involve risk and are not suitable for all investors.

Data and information is provided for informational purposes only, and is not intended for trading purposes. Neither www.optiontradingpedia.com, mastersoequity.com nor any of its data or content providers shall be liable for any errors, omissions, or delays in the content, or for any actions taken in reliance thereon. Data is deemed accurate but is not warranted or guaranteed. optiontradinpedia.com and mastersoequity.com are not a registered broker-dealer and does not endorse or recommend the services of any brokerage company. The brokerage company you select is solely responsible for its services to you. By accessing, viewing, or using this site in any way, you agree to be bound by the above conditions and disclaimers found on this site.

Copyright Warning :

All contents and information presented here in www.optiontradingpedia.com are property of www.Optiontradingpedia.com and are not to be

copied, redistributed or downloaded in any ways unless in accordance with our

quoting policy.

We have a comprehensive system to detect

plagiarism and will take legal action against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

Site Authored by

|